In only three months share prices of Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB) and Bank of China (BOC) have stumbled 29 percent, 27 percent and 21 percent respectively last Friday from the first trading day of 2008.

Investors were scared.

A meltdown in the US subprime mortgage market triggered a global credit squeeze that has roiled stock markets over the past few months, in which the banks owning subprime-related assets are standing in the breach.

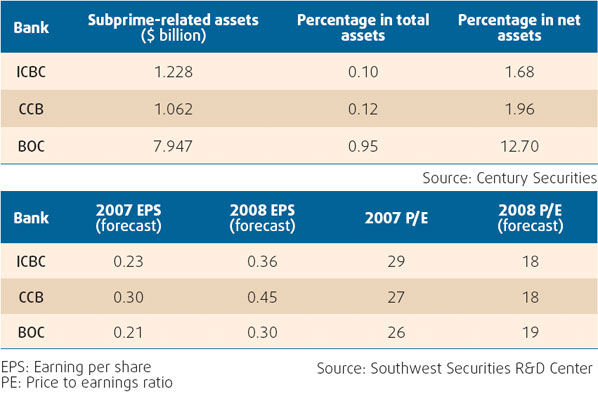

Citigroup, Merrill Lynch and UBS have lost $9.8 billion, $9.83 billion and $11.4 billion respectively in the fourth quarter of 2007, and the Chinese banks owing the subprime assets - ICBC, CCB and BOC- haven't dodged the crisis which has dragged down their stocks and made it difficult for the banks, which bought the subprime debts to resell them as their value dropped with serial defaults.

Limited impact

However, the depth of the subprime crises in the Chinese financial market will be limited and the impact on ICBC, CCB and BOC will not be significant, claims research reports by Zhao Jun of Southwest Securities, Yu Cong of Century Securities and Wang Qian of Industrial Securities.

Of the three banks, BOC and ICBC were the top two investing in the US subprime mortgage market.

The analysts claim the losses of the banks from the subprime debt will be very limited, since the three only own US$10.237 billion of subprime assets, accounting for less than 1 percent of their total assets, which is not significant enough to impair performance.

CCB, which owns US$1.062 billion subprime-related bonds and assets, says its revenue won't be affected by the crisis since the assets are a very small amount, accounting for only 0.12 percent of the bank's total assets and 1.96 percent of it net assets.

CCB says its subprime bonds account only for 2.75 percent of its total investment in foreign exchange bonds.

"CCB did incur a loss from the investment if calculated at the current market value of the securities," says Zhang Jianguo, president of the bank. But he says that the loss is well within CCB's capacity to handle.

He also says the US subprime bonds it held had high credit ratings of A or above, and more than 80 percent were rated AAA.

Analysts say the high ratings of its bonds exposed CCB to low risk from the credit crisis.

Wang Qian from Industrial Securities forecasts that the loss from the subprime bonds will only reduce CCB's 2007 EPS (earning per share) by 0.01 yuan.

ICBC said its subprime mortgage-backed and related securities were valued at $1.228 billion, accounting for 0.1 percent of its total assets and 1.68 percent of its net assets.

The bank had allocated 30 percent risk reserve - $61 million - to cover the losses from the subprime debts.

Jiang Jianqing, chairman of ICBC, says the bank's subprime debts will not deeply affect the bank.

Analysts say the loss from the debts will decrease ICBC's 2007 EPS by about 0.02 yuan.

BOC, the largest holder of the US subprime-related assets, owns $7.947 billion of subprime debts, accounting for 0.95 percent of the bank's total assets, and 12.70 percent of its net assets.

However, because the bank has actively improved its subprime-related portfolio and sold the comparatively risky part of the debts, its subprime assets have been greatly reduced.

The bank had disposed of all its subprime-related collateralized debt obligations (CDO), a high risk subprime bond, and set aside risk reserves of 1.15 billion yuan to cover losses from the subprime crisis.

But even for BOC, the loss for the 2007 EPS from the subprime assets is only 0.05 yuan, analysts forecast.

Upgrade risk management

Although the three banks will remain largely unaffected by the US subprime crisis, it's a warning for China's banks to upgrade their market risk controls and crisis management techniques, economists say.

Lewis Alexander, the Global Chief Economist of Citigroup says he agrees with Chinese economists and analysts that the subprime crisis is not a big concern for Chinese banks.

But he says a combination of the slowing economies of US and Europe, a tightening monetary environment and the correction of the real estate sector will continue to pose a market risk for the banks.

They will face more sophisticated risks in the future as the global financial market becomes increasingly liberalized, Alexander says.

The subprime crisis has taught Chinese banks a lesson in risk management. The risk awareness should be emphasized and the risk management should be enhanced for Chinese banks, economists say.

Ryan Tsang, senior director at Standard & Poor's adds that Chinese banks should also be cautious in monitoring loan applications and build up their capital to meet any fallout and financial crisis in the future.

(China Daily 03/17/2008 page3)