China is the world's largest maker of mobile phones, TV sets and air conditioners - facts often cited to demonstrate the country's formidable manufacturing capacity.

But economists now say this manufacturing powerhouse may fall prey to its own success as its humming factories and assembly lines are likely to suffer the headache of overcapacity amid a slowdown in the world economy.

"Overcapacity should become evident in the second half of the year in China when the nation's GDP growth falls below potential," warns Sun Mingchun, an economist with Lehman Brothers. The export sector, long China's economic growth engine, will be hit first, thanks to sagging demand in overseas markets.

Early indicators

Analysts say a few early indicators for overcapacity are looming despite record profits enjoyed by the nation's enterprises in 2007.

China's exports, combined with investment, have been the main catalysts of its economy. Between 2000 and 2007, China's exports of color TV sets increased fourfold, aluminum sevenfold, steel products 10-fold, mobile phones 12-fold and motor vehicles 27-fold.

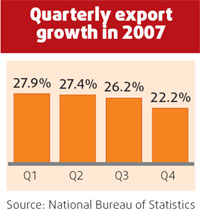

Thanks to impressive export growth, China has quickly risen to a major world exporter over the years. But recent figures show the nation's export sector is losing steam, largely due to weakening demand in the US and other markets.

In January, China's exports expanded 26.7 percent year-on-year to $109.66 billion. Although the growth rate is impressive, it was 6.2 percentage points lower than last January.

This slowdown may be just the beginning. Other economists say the nation's export growth will drop substantially throughout 2008. According to Ma Jun, an economist with Deutsche Bank, China's export growth will slow to 18 percent in 2008, down from 26 percent in 2007.

This slowdown presents gloomy prospects for the nation's manufacturers. According to Sun, about a quarter of China's industrial production is exported, so the weakening of these key export indicators raises the risk of overcapacity surfacing later this year.

Meanwhile, falling retail prices of some manufacturing products are also seen as a sign of overcapacity, analysts say.

Over the past year, China has experienced the worst inflationary pressure in a decade as its consumer price index gained 4.8 percent year-on-year, compared with just 1.5 percent in 2006.

While food prices such as pork and oil almost doubled over the past year, clothing prices dropped 0.6 percent during the period, despite rising costs in raw material and labor.

"Price deflation is often forced by fierce price competition, which is a good indicator of overcapacity," Sun says. "We expect more products to join the deflation group in 2009 as some of them are on the verge of deflation now."

Unmasking overcapacity

The nation's top policymakers had actually planned to deal with the potential of overcapacity two years ago.

In March 2006, the National Development and Reform Commission, the top economic planner, listed 10 sectors including steel and cement, where it thought overcapacity existed as a result of years of massive fixed-asset investment. The NDRC then stipulated a stricter review process and higher tax to rein in investment into these sectors.

These measures did help rein in new investment. Still, the nation's existing manufacturing capacity in many sectors already proved too big for the appetite of domestic consumers. For example, over half of the color TVs produced in the nation are sold overseas, while a whopping 80 percent of mobile phones are sold abroad.

"When external demand weakens significantly, overcapacity will become evident in those sectors," Sun says.

Analysts also note even some less export-oriented sectors may not be able to escape the export-led slowdown. When exports weaken, investments in the export sector will likely weaken as well. In turn, it will expose overcapacities in several sectors down the supply chain.

The nation's domestic market may come to the rescue. In 2007, retail sales growth jumped to an eight-year high. And consumption overtook investment to become the largest contributor to the nation's GDP growth, the first time since 2001.

China's success in rebalancing the composition of growth - between rural and urban areas, as well as across regions - will help local households develop a higher propensity to consume, says Frank Gong, an economist from JP Morgan Chase Bank, in a research note.

(China Daily 03/10/2008 page3)