|

Hefei Economic and Technology Development Area |

The past 30 years of China's reforms and opening up that began in 1978 stoked the economies in a number of the nation's coastal regions, including Guangdong, Zhejiang and Shanghai.

But as costs of land and labor rise - and electricity supplies fall short of demand - those economic heavyweights are giving way to once-obscure inland provinces in central China that are springing up as the next destination of investment.

Anhui, traditionally an agricultural province in China's central region, is among the new trendsetters, a fact that some observers find astonishing.

In the first three quarters of 2007, six central provinces, including Anhui, Henan, Hubei, Hunan, Jiangxi and Shanxi attracted $11.5 billion in foreign investment, a 46.2 percent increase over the same period the year previous and 24.3 percent of the national total.

Anhui ranked first in annual growth at 190 percent, 178 percent higher than the national average, and fifth place among the six by capital volume of $1.94 billion.

The province has attracted investment from both home and abroad, including big international names like ABB, Unilever and Hitachi.

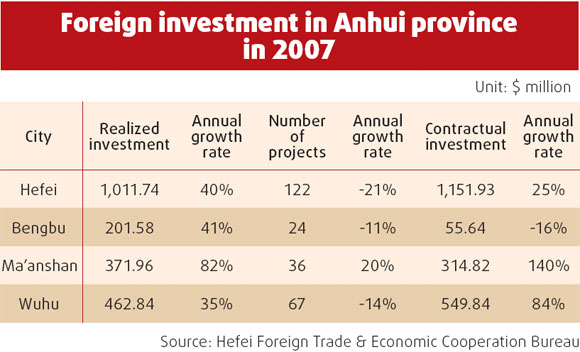

In 2007 alone, 499 new foreign enterprises registered in the province's cities of Hefei, Wuhu, Ma'anshan and Bengbu.

The capital Hefei, a six-hour bus ride west from Shanghai, is now home to more than 2,000 foreign enterprises, including 18 Fortune 500 companies. Along the Yangtze River, the city of Wuhu, another emerging spot for investment in Anhui, has attracted 34 Fortune 500 enterprises.

Lower costs, sufficient energy

An average consumer may ask - "why Anhui"? Unilever, an international producer of widely known brands in food, home care and personal products, provides an answer.

In 2002, Unilever announced it would move its manufacturing base from Shanghai to Hefei Economic and Technology Development Area at an initial cost of 250 million yuan, leaving Shanghai as its research and development center in China.

"This was a very wise decision that Unilever made," says Zeng Xiwen, vice-president for public affairs at Unilever Greater China.

Unilever arrived in Shanghai and built a manufacturing facility in 1986, but as the years passed, the company increasingly found the cosmopolitan city challenging as labor costs rose and an energy gap developed.

"In 1998, the average monthly salary in the Shanghai factory was more than 4,000 yuan," Zeng says.

Unilever China then began looking for a new factory site. For two years a team led by Zeng explored locations in the Yangtze River Delta, including the outskirts of Shanghai, east China's Zhejiang and Jiangsu provinces and Anhui.

"Anhui is a valuable investment destination, although it looks inconspicuous and was ignored, especially by foreign investors," Zeng says.

The Anhui factory came into operation in 2003 and now helps Unilever China reduce costs by at least 30 percent annually. It will soon become Unilever's largest manufacturing site in the Asia-Pacific region with an annual production valued at $1 billion, most of it exported overseas.

Compared with the coastal regions, Anhui "could provide cheaper land, sufficient electricity and skilled labor, besides convenient transportation", says Zeng.

Among the motivations to move are electricity shortages that add mounting pressure on the enterprises in highly developed coastal areas.

Since 2003, Shanghai, Zhejiang and Jiangsu have experienced electricity shortages.

So has Guangdong. The local government estimates it will have an electricity shortfall of 6.5 million kW in 2008 despite its continuing efforts to expand the supply.

But Anhui has no such worry. It has power capacity of 15.8 million kW, which could meet the entire provincial demand. Four more power projects were approved last June that will increase the capacity to 30 million kW when operational in 2010. Part of the power will be transmitted elsewhere in the Yangtze River Delta.

Insufficient labor and higher salaries also now part of the matrix in the booming costal region.

The minimum monthly salary in Guangdong has gone up seven times over the past few years and is set to rise again to 880 yuan from 780 yuan.

In Shanghai, the minimum monthly salary is 840 yuan, in Jiangsu it is 850 yuan and in Zhejiang, it ranges from 850 to 620 yuan. In Anhui, the wage varies from 560 to 390 yuan.

Given its 80-odd universities and colleges, Anhui also has abundant skilled labor to staff its factories, while in Guangdong and Zhejiang, companies have to look for talent in neighboring regions like Hunan, Anhui and Jiangxi.

An incentive

The transfer wave may continue to rise as over 2,000 companies in the Pearl River Delta, long China's manufacturing heart, are reported to have closed down factories recently due to the appreciation of the yuan, reduced export tax rebates and rising costs.

The news is a blessing for Anhui as investors turn their eyes to cost-effective inland provinces, including Anhui.

"This is a fantastic opportunity. We are seeing the positive effects," says Wu Jing, director of Hefei Bureau of Commerce.

Hefei ranks the first by investment volume across Anhui, accounting for about 30 percent of the total. Business groups from Zhejiang, Jiangsu and Guangdong visit the city's industrial zones almost every day, says Wu.

"We are also strengthening efforts on promoting ourselves, holding exhibitions and fairs in those regions."

In 2007, Hefei identified attracting investment as a major task and organized teams to help.

Competing hard

But it is not only Anhui that is active in luring new investment - so are Hubei, Hunan, Jiangxi, Shanxi and Henan, the other five provinces of central China, which all enjoy rich natural and human resources. They are also included in the nation's strategic development plan termed the "Rise of Central China".

The idea was firstly advanced in 2004. By April 2006, a detailed guideline on promoting development of central China was produced. The State Council gave its nod to the proposal last December for nine cities in the Hubei Economic Circle and three cities in the Hunan Economic Circle.

The two local governments are now working on details of the proposal, from improving infrastructure to encouraging innovation, which could eventually pose a challenge to Anhui.

Jiangxi is another competitor. From January to September 2007, Jiangxi ranked second in central China with foreign investment of $2.48 billion. The figure will be $3.4 billion this year, the local government projects.

Transportation, a key factor considered by investors, is improving in Jiangxi, partly due to a joint venture between Jiujiang Port, one of the 13 major ports along the Yangtze River, and Shanghai International Port Group (SIPG), China's largest port by cargo throughput. SIPG will hold 91.67 percent of the venture and help Jiujiang Port improve its management and operations.

But Zeng from Unilever says Anhui has the advantage in transportation over Jiangxi. He notes that Jiangxi was a candidate for the company's manufacturing site, but Anhui was selected due to transportation considerations.

Anhui ranks third in central China in length of superhighways behind Henan and Hubei, with a total of 2,205 km.

Last year, Anhui invested 24.8 billion yuan to improve transportation and will spend another 100 billion yuan over the next four years to build a more efficient transport network.

By 2012, provincial superhighways will total 3,500 km, at which time its port capacity is projected to grow to 390 million tons from 240 million tons in 2007.

(China Daily 02/25/2008 page10)