Last Tuesday, China Development Bank paid 2.2 billion euros for 201.4 million new shares, or a 3.1 percent stake in Barclays Bank, to support the latter's bid for ABN AMRO. Only a month ago, Bank of China (BOC) opened a new branch in Rotterdam, its first in the Netherlands.

While foreign banks have been making significant inroads into China in the past year as the country opens up its banking market, domestic banks are increasing their presence in the world market.

"There will be a definite trend of Chinese banks going global," says Professor Zhao Xijun of Renmin University of China. "This ties in with the need of domestic banks to follow their corporate customers abroad."

And as Chinese companies expand their international presence, they need a wider range of financial products and services, such as trade financing, loans, payment and settlement in countries where they are in business.

A typical example is Dubai, the financial hub of the Middle East, where there are over 100,000 Chinese and thousands of small Chinese companies but not a single operation of any Chinese financial institution.

Earlier this year, the Dubai International Financial Center, the local financial authority, took part in a series of programs to promote itself, including sponsoring British magazine The Bank's list of top 100 Chinese banks, to attract Chinese financial institutions to the city-state.

"We have to speed up overseas expansion as part of our efforts to improve our competitiveness," says Pan Gongsheng, secretary to the Industrial and Commercial Bank of China's board of directors. Otherwise, he warns, domestic banks may lose corporate clients to big foreign rivals.

Self-help

And for now, domestic banks' focus overseas must be serving Chinese enterprises, rather than competing with foreign rivals for local customers. "That would be difficult in a short period," Zhao says.

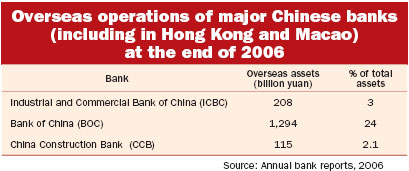

Although overseas investments by Chinese banks can be traced back to as early as 1929, when BOC set up a branch in London, foreign operations still account for just a sliver of total banking business.

Take BOC for example the bank has the largest overseas assets among its peers, yet Its overseas assets, excluding Hong Kong and Macao, totaled 214.73 billion yuan by the end of 2006, accounting for just 3.84 percent of the bank's total. Foreign operations contributed only 2.82 percent to the bank's net profit last year.

But things may be changing. Among the first group of domestic banks taking steps to make their presence felt in the global market are ICBC and BOC. These two have already broken into the big league and are counted among the world's Top 10 banks. China Construction Bank (CCB), which ranked No 14 in The Banker's annual Top 1,000 bank list, is also making similar moves.

These banks are backed by their massive initial public offerings (IPOs) in the past two years and strong businesses fueled by China's steaming economy. None of the three banks were in the top 20, even in 2004.

"Successful share reforms and massive IPOs, which strengthened their capital base and helped improve their management, have enabled domestic banks to adopt new forward-thinking strategies for global expansion," says Zhao from Renmin University.

ICBC's Pan agrees. He says foreign acquisition couldn't be farther away from the bank's thoughts only a few years ago, struggling as it was with bad loans and financial restructuring.

The bank bought into Indonesia's Bank Halim last year, following BOC's acquisition of Singapore Aircraft Leasing Enterprise and CCB's acquisition of Bank of America (Asia) Ltd.

Grow or buy?

Domestic banks are clearly on their way to extend their global reach both by setting up branches and through mergers and acquisitions. But "compared with the traditional route of opening new outlets abroad, purchasing stakes in overseas banks is a relatively more convenient and efficient expansion model", says Zhao.

"In many markets, new outlets of overseas banks often encounter obstacles in terms of client resources and regulatory supervision, so direct purchasing is the way to go for Chinese banks," he says.

CCB has seen immediate gains from its acquisition of Bank of America (Asia). With 17 outlets of that bank in Hong Kong and Macao, CCB has more than doubled its presence in these places. CCB (Asia), as a result, has climbed to the No 9 slot from the previous No 16 among Hong Kong banks, in terms of granting loans. ICBC (Asia) has also moved into the No 6 position in Hong Kong by assets through a series of M&As.

Pan says the bank's new branches overseas, despite their good performance, cannot help build up business scale and influence the local market in a short period as effectively as M&As can.

"Going out is a trend for Chinese banks, but the speed won't be that rapid," says Yin Jianfeng, a researcher with the Institute of Finance and Banking at the Chinese Academy of Social Sciences.

Difficulties

Going out comes with its own set of problems, both from the regulatory side and from within the banks themselves.

One of the impediments is the strict entrance requirement for foreign financial institutions in the developed world, where Chinese banks face entry barriers because of a history of poor risk management and corporate governance. The US, for example, has not granted business licenses to Chinese banks for decades.

But ICBC and China Merchants Bank might soon get the nod to upgrade their representative offices in the US to branches as American authorities agreed to consider their applications under "the principle of national treatment" during the bilateral strategic economic dialog.

"The regulatory restrictions in developed countries probably mean that Chinese banks will limit themselves geographically to Asia in the near and medium term," says May Yan, banking analyst at rating agency Moody's.

ICBC admits that its focus will be on emerging markets. "We should take the opportunity that China is growing trade and economic ties with the emerging markets," Pan says. According to him, domestic banks should prepare internally for future overseas expansions, especially in talent reserves and information technology.

ICBC has built up a reserve of talent in recent years, but still, cultivating domestic professionals and recruiting local staff overseas are important for the bank's overseas expansion.

Another task at hand is building an advanced information technology system. "We started to map out an IT plan for overseas expansion three years in advance."

(China Daily 08/20/2007 page1)