For more than three thousand years the story of the Trojan War has been retold from generation to generation, recounting the legendary 10-year conflict between Greece and Troy over a beautiful woman named Helen.

Today another Trojan legend of sorts is going eastward as the condom brand Trojan, made by United States company Church & Dwight Co Inc, arrives in China.

Like the fabled war, the condom battle might take Trojan a number of years as China's market is both immature and highly competitive.

Church & Dwight, a US producer of household and personal care products, announced in April that it will introduce one of its best-selling condom brands in China.

With nearly 100 years of history, Trojan has a leading position in the US and Canada with a market share of 75 percent.

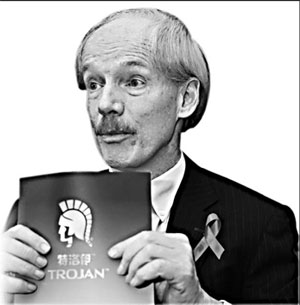

The brand also aims high in China. "We expect to double volume and sales here annually over the next few years," says Richard Lister, general manager of Church & Dwight (Beijing) Trading Co Ltd, who declines to elaborate further.

China is not entirely new to Church & Dwight. In late 2005, the company acquired SpinBrush, a domestic battery-powered toothbrush business, from Procter & Gamble, making Trojan the company's second brand in China.

Condom sales in China were estimated to be 2 billion in 2006, following only the United Kingdom, the US and Japan. It is expected to grow 15 percent annually.

In addition to the world's largest population, the steadily growing number of HIV/AIDS cases in China is also driving market growth. According to a report from the Ministry of Health, HIV patients reached 183,733 by the end of October 2006.

National and local municipal governments have made efforts to encourage the use of condoms among the Chinese. A proposal to allow advertising of condoms, which was before forbidden, was passed by the State Administration for Industry & Commerce in June 2004, but on a restricted basis.

Yet success in China's market may not be an easy task for Trojan.

"Condom" is still a taboo word in most Chinese regions, where awareness of the importance of condoms and how to properly use them is lacking, although in the major cities of Beijing, Shanghai and Guangzhou there is a more mature understanding.

Government purchases actually take quite a big share of the market. It was reported that in 2006, six billion condoms were produced, with more than one-fourth bought by the Chinese government for public distribution. International brands have never been on the purchase list.

Trojan is conscious of the situation, and what the company is considering is "trying to educate the market and to work with the government" as many of its peers have been doing.

"We will try multi-faceted measures, including distribution, advertising and partnerships with the government, universities and related organizations, to communicate with both the youth and the middle-aged, helping them know it is the right thing to use condoms and how to use them intelligently," says Lister.

"It really takes time, but it is critical to success," he says.

The company has embarked on partnerships with two top Chinese universities, Peking University and Tsinghua University, for HIV-related campaigns. Advertisements in the capital's subways have arrived in May.

Another challenge Trojan has to face is intense competition.

It is estimated that there are more than 120 condom manufacturers and 2,000 condom brands in China. But according to the National Population and Family Planning Commission of China, the number of condoms manufactured in China that pass quality tests is less than 60 percent.

Lister says Trojan's quality could separate it from the others.

To build confidence and trust among Chinese consumers the company will first import condoms from the US.

"We will not consider manufacturing in China until two to three years later because quality is too important to consumers," says Lister.

Although imported, the prices of Trojan condoms would not exceed the average in the local market, he says, but that will undoubtedly increase the company's costs and scale back its profits.

UK-based Durex and domestic brand Jissbon are currently the top two by market share, and Trojan's biggest direct competitors.

Both established a presence in China in 1998.

Durex's parent company, SSL International PLC, joined with Qingdao Double Butterfly Group Co Ltd for a manufacturing factory with investment of $7.9 million to meet local demand. Its annual output is 140 million with a yearly growth in sales of 30 percent.

Early this year SSL bought the other 50 percent share from Double Butterfly, turning the joint venture into a wholly controlled company.

Due in part to its new products and social awareness campaigns, including the Annual Global Sex Survey that began in 1996, Durex has led the high-end market in China's major cities, as it does in 40 nations worldwide.

Jissbon was established in Wuhan, the capital of Hubei Province, and has been successful in the medium-priced market and secondary cities due to its long-standing involvement with local governments and HIV prevention campaigns.

Lister from Church & Dwight declines to comment on the competitors, saying the company's promotion efforts will first focus on key cities including Beijing, Shanghai, Guangzhou, Shenzhen and Chengdu.

"We would not work with secondary cities until two years later, when we expect Trojan products to be available whenever and wherever consumers want, in supermarkets, chain stores, drug stores, hotels and entertainment venues," he says.

(China Daily 05/28/2007 page3)