Bruce McLaughlin, an adviser to major Chinese investors in Australia, told Xinhua, "Negotiations have been going on for a very long time, and it seems to me that both sides' negotiating teams have been hamstrung by domestic issues."

McLaughlin noted Abbott's confirmation that investment in Australia by Chinese State-owned enterprises would be welcome "if it's in Australia's national interest, and I think that in most cases, this investment will be in our interest."

"This statement alone form Abbott at the APEC summit shows how much the situation has improved.

"When we look at the enormous benefits that both New Zealand and China have seen from their FTA, it's clear that an agreement will be great news for both Australia and China," McLaughlin said.

The Australia China Business Council (ACBC) has long supported the conclusion a wide-ranging agreement, arguing an FTA would provide an inherent value above and beyond the obvious economic benefits.

ACBC Senior National Vice President Duncan Calder told Xinhua, "As a council, we continue to support the introduction of a free trade agreement between China and Australia."

An agreement the ACBC estimates could deliver A$150 billion in value over a 20-year period to both Australia and China.

"The symbolism of friendly nations compromising and navigating sensitivities to deliver such an agreement would in itself be as powerful a message as the economic outcome."

The stuttering bilateral negotiations began in 2005 and despite 19 intense rounds of discussions (Australia was the first country to formally agree to an FTA with China), and other countries including neighboring New Zealand have already concluded pacts with the world's most important economy.

While a trade deal would almost be universally welcomed here, concerns remain over access to agriculture markets, services industries and the development of education exchanges.

Writing in the Australian Financial Review, Laurie Pearcey, director of China Strategy and Development and director of the Confucius Institute at UNSW, said that while the stakes are high for Australia's farmers, bankers, fund managers and companies looking to increase their investment footprint into China, it is the international education sector Australia's quiet achiever that stands to gain from mutually accessible markets.

Asia Bike Trade Show kicks off in Nanjing

Asia Bike Trade Show kicks off in Nanjing

Student makes race car for 4th Formula SAE of China

Student makes race car for 4th Formula SAE of China

Beijing suburb to hold 2014 APEC meeting

Beijing suburb to hold 2014 APEC meeting

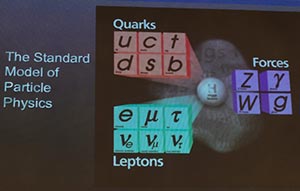

Belgian, British scientists share 2013 Nobel Prize in Physics

Belgian, British scientists share 2013 Nobel Prize in Physics

Model with modified BMW X6 M SUV

Model with modified BMW X6 M SUV

'Golden Week': No pain, no gain

'Golden Week': No pain, no gain

Car firms shifting focus

Car firms shifting focus

A slice of paradise lures tourists

A slice of paradise lures tourists