The company's success is down to its founder, Liu Chuanzhi. In 2008, because of poor market performance, the company sold its mobile business to "concentrate on the PC sector", but Liu decided to buy it back in 2009.

Then the company established a mobile Internet division in 2011 and launched its first smartphone - LePhone. Lenovo presented its second-generation smartphones LePhoneS2 and K800 this year.

"Since Lenovo became the second-largest PC maker globally (in the second quarter of 2011), we have been putting greater emphasis on mobile Internet products and cloud-computing markets," said Yang Yuanqing, president and chief executive officer of Lenovo.

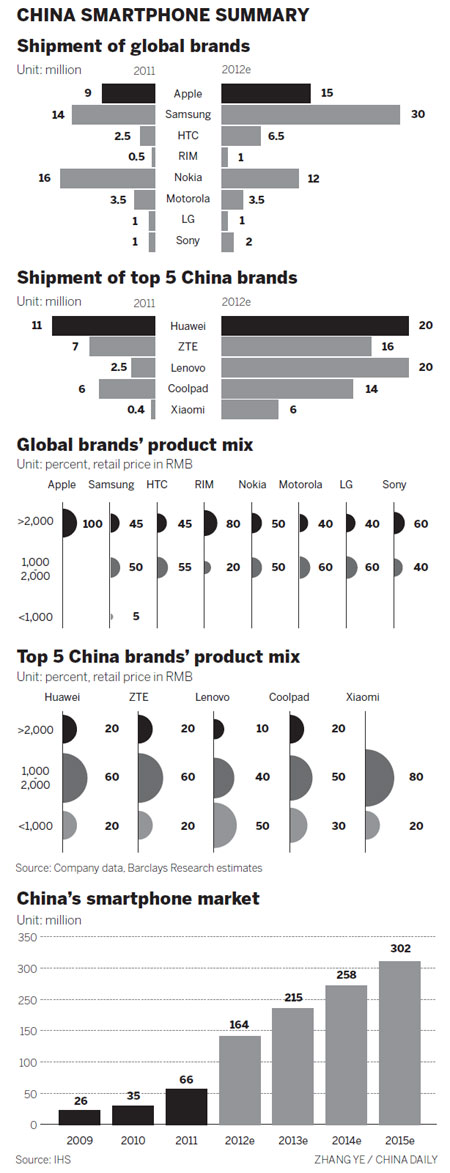

Lenovo reported its smartphone shipments exceeded that of its PCs for the first time in history in the second quarter of 2012. About 6.8 million handsets were sold during the quarter, the company said.

ZTE Corp, the world's fifth biggest telecom equipment maker, has made huge strides in the mobile phone sector in recent years as the company looks beyond the traditional telecom industry for new revenue drivers.

The company has developed into the world's fourth mobile phone vendor and aims to ship more than 30 million smartphones this year, doubling the figure of last year.

Huawei Technologies Co, expressed its ambition earlier this year to ship more than 100 million mobile phones in 2012. Huawei hopes to be among the world's top three mobile phone vendors in five years.

"The major advantage for Chinese handset manufacturers is that they usually adapt quickly to market demand. In addition, being homegrown, they understand the culture and nuances of their Chinese customers," Egidio Zarrella, a partner at KPMG China, said in an email to China Daily.

Unlike Apple, which probably takes a year to research and test a new model, Chinese mobile phone manufacturers have a much higher productivity rate.

"From the idea to the actual handset hitting the market, the fastest Shenzhen producers only need 20 days," said Sun Wenping, secretary-general of the Shenzhen Mobile Communications Association. Shenzhen is a mobile phone production hub with a complete supply chain in South China.

He Shiyou, executive vice-president of ZTE Corp, said the average lifespan for a smartphone in China has become much shorter now, probably between three and six months. "Therefore ZTE has to move fast in order to not lag behind," he said.

However, domestic rivals may not have the knowledge or skills to bring global ideas into the Chinese market to drive innovation - innovation from seeing all ideas and then adapting them to your own market, Zarrella said.

One of the key competition weapons that Chinese vendors resort to is price but price wars lead to lower profit margins and impose negative effects on branding, said Sabrina Ren, a research manager at Germany-based GfK Group.

"Apart from a few manufacturers, currently lots of Chinese brands rely on the turn-key solution from the chipset provider and do not have strong enough research and development capacity compared with global competitors," Ren told China Daily.

Internet companies

While what used to be movers and shakers in the global mobile phone making industry have been going downhill, an increasingly large number of Internet companies have made their way into the business.

Since last year, major Internet companies have come up with their own smartphones employing different tactics, including pre-installing mobile applications, providing mobile operating systems and making the handsets themselves.

|

|