Exchange Fund performance difficult to predict amid uncertainties: HKMA

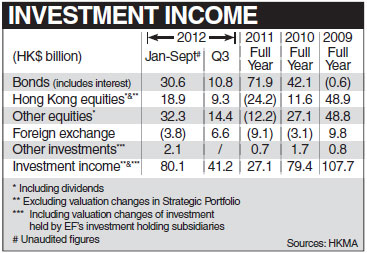

The Exchange Fund managed by the Hong Kong Monetary Authority generated an investment income of HK$41.2 billion ($5.31 billion) in the third quarter, boosted by investor optimism in the global asset markets.

The Q3 results, which reversed a HK$5.6 million loss registered by the Fund in the second quarter, also compares with a net investment loss of HK$41.4 billion in the same period a year earlier.

|

|

The Exchange Fund has paid HK$9.2 billion to the government as fiscal reserves. In the first nine months of 2012, the Exchange Fund had generated HK$28.5 billion fiscal reserves to the government in total.

In the third quarter, bond investment, Hong Kong equities, other equities and foreign exchange had recorded investment incomes of HK$10.8 billion, HK$9.3 billion, HK$14.4 billion, HK$6.6 billion, respectively.

The HKMA is the key manager of the Exchange Fund, which is under the control of the financial secretary. The Exchange Fund's investment income is used to back the Hong Kong dollar.

|

|

"Amid heightened concerns about (the) economic environment in the eurozone area, major equity markets in developed economies suffered a correction in the second quarter that erased most of the gains recorded in the first quarter, but rallied in the third quarter on investor optimism that more accommodative monetary policies of the major central banks would be forthcoming," the HKMA said in a statement.

For the nine months of 2012, the investment income of the Exchange Fund stood at HK$80.1 billion, also a drastic improvement from the same period a year ago when the investment income only totaled HK$5 billion.

"The global financial market expects the investment risks associated with the US fiscal cliff to increase," HKMA Chief Executive Norman Chan said at the Monday briefing in the Legislative Council. "Together with the rise of geo-political risks, it is hard to predict the performance of the Exchange Fund in the fourth quarter."

"The HKMA has finished the review regarding the formulation of the Exchange fund's investment diversification strategy and will disclose the details to the public in early 2013," Chan noted.

The HKMA is gradually diversifying the Exchange Fund's assets into emerging markets' shares and bonds, private equity funds, real estate investment as well as yuan-denominated equities and bonds. As at September this year, the total asset value of new asset types amounted to HK$131 billion.

Chan also said that the HKMA injected a total of HK$32.2 billion into the local banking system when strong-side convertibility undertaking was triggered in late October. The aggregate balance of the local banking system rose to HK$180.9 billion on Nov 6.

"Amid the global economic and financial uncertainties, and the slowing down of the Hong Kong economy, the HKMA will take precautionary measures to guard against the global extraordinary financial environment to prevent drastic capital inflows or outflows," Chan reiterated.

oswald@chinadailyhk.com