But analysts still suggest chances are good that offer will be approved

China's potentially largest overseas acquisition to date was clouded by an insider-trading investigation that the US launched last week, but analysts said the charges shouldn't affect US regulators' decision on whether to approve the deal.

Instead, analysts said, overseas politics that pose a potential threat to the deal should be a greater concern to CNOOC Ltd more.

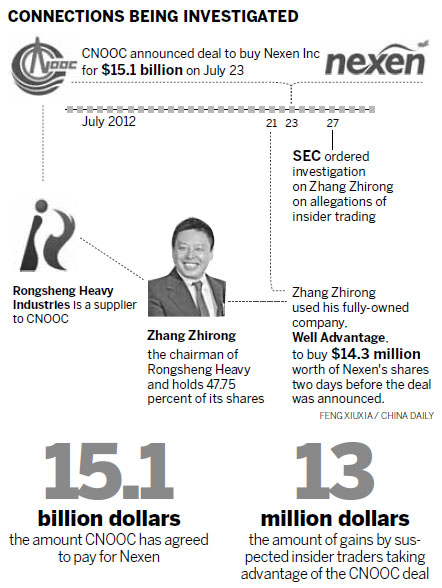

On Friday, the US Securities and Exchange Commission obtained a federal court order to freeze the assets of traders who were alleged to have reaped more than $13 million from illegal trades ahead of CNOOC's announcement that it would buy Nexen Inc, a Canadian oil group.

If the deal passes the review process, CNOOC could boost its proved reserves by 30 percent and increase its production by 20 percent.

Before the announcement, Hong Kong-based Well Advantage Ltd, controlled by Zhang Zhirong, and other unidentified traders stockpiled shares of Nexen after knowing confidential information about the deal, the SEC said in a statement announcing a complaint filed in US court.

Zhang, 43, is the chairman and founder of China Rongsheng Heavy Industries, a Chinese shipbuilder.

The SEC said businesses owned by Zhang, including China Rongsheng Heavy Industries, have a close relationship with CNOOC.

Rongsheng Heavy, which is China's largest private shipbuilder by order book and was co-founded by Zhang in 2005, signed its first offshore engineering contract with CNOOC to build a 3,000-meter deepwater-pipe-laying crane vessel for the offshore oil producer. Former financial reports released by Rongsheng Heavy, a Hong Kong-traded company, said the company signed a strategic agreement with CNOOC in 2010.

By pinpointing Zhang's close relationship with CNOOC, the SEC laid the groundwork for its allegation that Zhang's company was involved in insider trading. Before the purchase of the Nexen shares, which took place just two days before the deal was made public, Well Advantage had not traded Nexen shares since January. And immediately after Nexen's stock rose 52 percent, Well Advantage sold the shares.

CNOOC so far has not yet officially responded to the case and whether the development will affect its purchase of Nexen. But the 21st Century Business Herald, citing an anonymous source in CNOOC, reported that the company has initiated an internal investigation to determine how information about the deal was leaked.

"There were not many people who knew the details of the acquisition," the source said.

Nexen announced the $15.1 billion, all-cash equity offer from CNOOC on July 23.

Industry experts said the chance of the deal's approval by Canadian regulators is very high. Uncertainty about the case comes mainly from US regulators.

In 2005, CNOOC withdrew its bid for the US oil company Unocal Corp after the offer drew stiff opposition in Washington. Nexen has about 10 percent of its assets in the US Gulf.

However, experts interviewed by China Daily said the SEC case itself will not exert a significant effect on CNOOC's acquisition. Politics could be a greater threat.

"Insider trades happen. And anybody in this process can do it. Lawyers, underwriters, you name it," said Tao Jingzhou, managing partner of Dechert LLP Asian Practice.

"Insider trades could not have impeded the acquisition unless they evidently affected the bid price. So I don't think they will have significant affect on CNOOC's acquisition."

Ge Shunqi, a professor with Center for Transnationals' Studies of Naikai University, said that "the SEC's probe is irrelevant to the acquisition case."

zhengyangpeng@chinadaily.com.cn