Many companies note competitive price, branding pressure from domestic firms

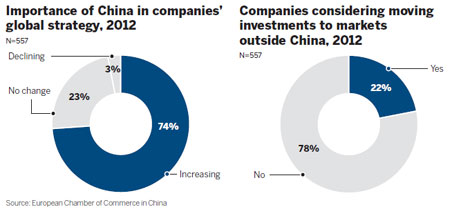

Nearly one quarter of European companies operating in China said they will consider shifting investment to markets outside China, while nearly three quarters said China is among their top three destinations for future investment, a survey released on Tuesday showed.

A slowing economy and rising labor costs were seen as the top risks for companies operating in China, the European Chamber of Commerce in China said in its annual business confidence survey.

|

|

|

A technician works at the Airbus assembly plant in Tianjin. A survey has found that nearly three-quarters of European companies said China is among their top three destinations for future investment. [Photo/Xinhua] |

"A previously reliable stream of foreign direct investment (FDI) may slow and planned investments may be shifted to other emerging markets if reform continues to stall and costs rise," said Davide Cucino, president of the chamber.

FDI from the European Union, its largest trading partner, slumped 27.9 percent year-on-year to $1.9 billion in the first four months, according to the Ministry of Commerce.

Rising labor costs are regarded as a significant concern by 63 percent of 557 respondents, especially employers in the Pearl River Delta in South China, said the survey.

Cost reduction is becoming a more frequently used strategy by European companies to sharpen their competitiveness. The survey showed a growing number of companies looking to cut costs rather than increase revenue in China.

Wang Zhile, director of the Research Center of Transnational Corporations at the Chinese Academy of International Trade and Economic Cooperation, said it is natural for cost-oriented companies to shift investment to lower-wage areas in Southeast Asia and elsewhere.

"However, even for cost-oriented companies, a better price-performance ratio is more important than lower labor costs. Given China's labor productivity, rising wages are still acceptable," said Wang.

Investors take into account many factors beyond costs when making investment decisions, such as markets and supply chains, he said.

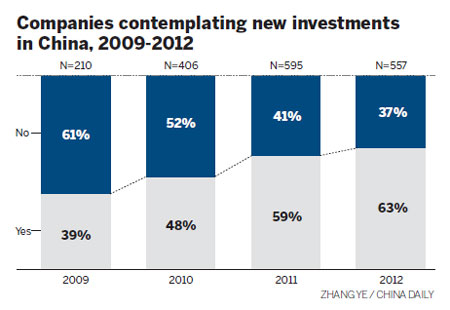

According to the survey, 63 percent of the companies plan to make new investments in China in the next two years, up 4 percentage points from a year earlier.

The lingering eurozone debt crisis has greatly weakened purchasing power in Europe. Only 13 percent of respondents said the top strategic reason for operating business in China was providing goods and services for the European market, down 9 percentage points from a year earlier.

About three quarters of the respondents said the top strategic reason for operating in China is providing goods and services for the Chinese market.

The American Chamber of Commerce in China recently said that about 66 percent of US companies are producing or sourcing goods or services "in China, for China".

European companies "overwhelmingly" regard China as a driver of their global business, said the European chamber.

About 74 percent of the surveyed companies said China is becoming increasingly important in their overall global strategy and another 23 percent said China is as important as in 2011.

Foreign businesses operating in China are under increasing pressure from Chinese competitors as they become more reliant on the mainland market.

Nearly half said they are facing increasing pressure from Chinese private enterprises, which are increasingly competitive in pricing, branding and sales.

State-owned enterprises are for the most part in strategic sectors that are "not open to foreigners", so their competition is not so significant, said Cucino.

The survey also said the development of the regulatory environment is not in step with the development of the market, and suggested that the reform of the regulatory environment will be the key driver of future growth.

lanlan@chinadaily.com.cn

|

|

|