|

|

|

|

|||||||||

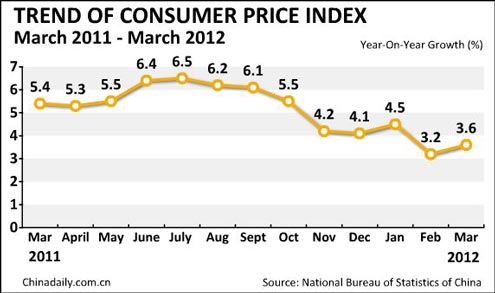

BEIJING - China's inflation rebounded slightly in March after logging a relatively low growth in February, but analysts generally believe prices will drift lower in the following months despite lingering uncertainties.

China's consumer price index (CPI), a main gauge of inflation, expanded 3.6 percent year-on-year in March, the National Bureau of Statistics (NBS) said Monday.

The growth represents a climb from the 3.2-percent rate registered in February, the lowest pace in 20 months.

Despite the rebound, analysts said the overall downward trend of inflation will not be changed for the whole year as factors that drove up the index are mostly short-lived.

As a major driver of the growth, China's food prices, which account for nearly one-third of the weighting in the CPI calculation, increased 7.5 percent last month from one year earlier.

Statistics from the Ministry of Commerce (MOC) showed that the wholesale prices of 18 staple vegetables rose for four consecutive weeks from February, posting an increase of 9.7 percent by early March.

Tang Jianwei, senior analyst at the Bank of Communications, attributed the surge to inclement weather and held that the trend will be stemmed when the weather gradually warms up.

Citing MOC data, he said vegetable prices already began to drop in late March.

The price of pork, China's staple meat, went up 11.3 percent year-on-year in March, pulling back 4.6 percentage points from February.

Prices of non-food items climbed 1.8 percent year-on-year in February, up 0.2 percent on a monthly basis.

The latest rebound also comes as the public fret over fuel price hikes that have triggered a fresh wave of inflation concerns.

To reflect price changes on the international crude oil market, China last month lifted fuel prices for the second time in a year.

Though oil price hikes have had only a minor impact on CPI growth as fuel only plays a small part in the calculation, the pass-on effect, which would affect the key logistics sector, should not be ignored, analysts said.

Zhao Xijun, deputy dean of the School of Finance at Renmin University, said the price rises will gradually be reflected in the index when squeezed enterprises begin to pass on the cost to consumers.

He also warned about possible risks of imported inflation because of volatility in the international market, adding the biggest uncertainty lies in oil prices if the situation in the Middle East worsens.

Even though uncertainties abound, analysts are largely optimistic that the government can meet its price control target for the year, as the rounds of tightening policies earlier on will continue to wield influence.

The government is aiming to keep CPI increases to around 4 percent.

The country's CPI climbed 3.8 percent in the first quarter compared with the previous year.

China's inflation went beyond the government's full-year target of 4 percent last year, hitting 5.4 percent, and only begun to show signs of easing this year as the government's efforts to hem in the runaway prices gradually worked.

China's central bank raised banks' reserve requirement ratio (RRR) 12 times to a record high of 21.5 percent between 2010 and December 2011. It has also hiked interest rates five times since October 2010.

As inflation concerns gradually ease, the government is taking cautious steps, including an RRR lowering in November 2011 and again in February this year, to loosen policies in a bid to spur the slowing economy.

Lu Zhengwei, chief economist of the Industrial Bank, said he expects another cut later this month.