Lian Ping, chief economist with the Bank of Communications, said that liberalizing lending rates will benefit the real economy.

"Large and medium-sized enterprises with good qualifications will have stronger bargaining power when seeking loans, and in this sense, the move will help stabilize economic growth," said Lian.

On the other hand, micro and small enterprises, which usually accept interest rates 10 to 30 percent above the guideline rate, will become more attractive to banks. This will ease the credit crunch among small businesses.

According to the PBOC statement, controls on bill discount rates would also be scrapped and the ceiling limit for lending from rural banks would be eliminated.

Zeng Gang, a researcher with the Chinese Academy of Social Sciences, said the cancellation of the ceiling limit for lending by rural banks will encourage rural banks to lend, and help address the difficulties of financing for micro-sized companies in rural regions.

However, the central bank did not remove the ceiling on deposit rates, and retained the lending interest rates for personal housing for the healthy growth of the property market.

Ba said that freeing deposit rates will have a more profound impact, and it needs in place mature mechanisms regarding deposit insurance and risk management, which are yet to be improved and rolled out.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

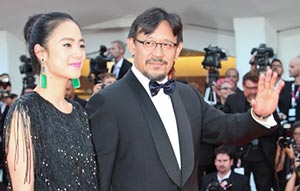

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant