|

|

|

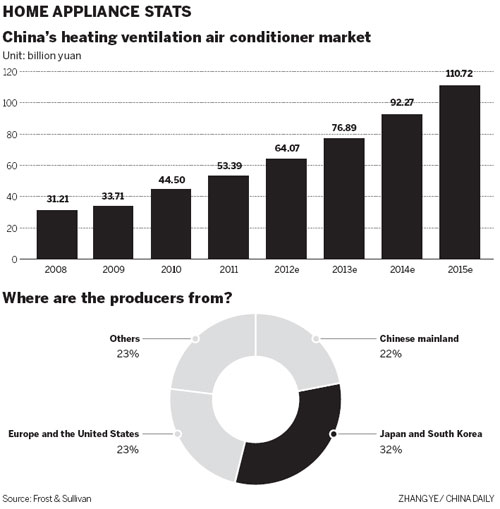

A sales clerk explaining the functions of air conditioners to a woman at an electrical appliances store in Nantong, Jiangsu province. China now has the largest heating ventilation air conditioner market in the world. It is also the largest manufacturer of such products.[Photo / China Daily] |

When 35-year-old Yuan Bao stepped into a Dazhong Electronics store in the Changping district of Beijing, he found he was the only customer in the three-floor home appliance outlet.

"I was really surprised because the only people in the store were salespersons," said Yuan. The public servant said he wanted to buy two air conditioners after redecorating his old apartment but found it hard to find a salesperson to talk to. "It's weird that no one seems to be buying air conditioners at present," he said.

"There are almost no customers from Monday to Friday," said a saleswoman at the Panasonic air conditioner counter. "Right now, it is the off-season for air conditioners. Our business usually gets better in summer."

It's not only down to the off-season reason. The saleswoman said the slowdown of air conditioner sales is also because Chinese government's consumer subsidy programs have ended, "Most customers have delayed their purchases while they wait for the new subsidy programs," she said.

To promote China's domestic consumption and energy efficiency, China's government introduced three different policies to stimulate the purchase of energy-saving home appliances. They are named Government Subsidy to Energy-Saving Household Appliance, Household Appliance Trade-in and Home Appliance Subsidy Program for Rural Areas.

Hundreds of household appliance manufacturers benefited from these policies from 2009 to 2011, with the air-conditioning market gaining momentum alongside the markets for other household appliances.

According to iSuppli, a US technology value chain research and advisory service, manufacturers shipped approximately 50.1 million air conditioners to the domestic market in 2010, up 61 percent from 31.1 million units in 2009. This marked the first time the local air conditioner market exceeded the 50 million mark.

However, by June 2011, Government Subsidy to Energy-Saving Household Appliance came to an end. Household Appliance Trade-in finished at the end of 2011. It is expected that Home Appliance Subsidy Program for Rural Areas will be closed down by the end of 2012. Without the assistance of policies, it is clear that sales in the household appliances market will decline, especially those of Chinese room air conditioners, according to Frost & Sullivan, a US business research and consulting firm.

In addition to the withdrawal of government policies, there are multiple negative factors that will affect sales in the sector, such as a decline in exports, an increase in the cost of raw materials and an inventory backlog, Frost & Sullivan said.

In 2011 the appreciation of the yuan, the slump in the global financial market, rising raw material prices, the doubling of labor costs and an increase in transportation costs hit sales of Chinese room air conditioners indirectly. The rise in raw material and labor costs especially affected profits.

During the three-year bull market, thanks to policy support, most room air conditioner manufacturers expanded production capacity blindly. The latest statistics show that the inventory backlog was more than 20 million units by the end of 2011. China's three biggest room air conditioner manufacturers by sales, Midea, Haier and Gree, were affected by a huge inventory backlog in 2011. As a result, the cash flows of many manufacturers became weak. To solve the problem of liquidity, most manufacturers began to lay off workers. Midea had laid off 50 percent of its sales staff nationally by the end of 2011.

"The slowdown in the home appliance industry presents a very good opportunity for domestic appliance makers to upgrade their products with technological innovation, improved product efficiency, energy saving and the overall comfort of use," said Wang Lei, deputy secretary-general of the China Household Electrical Appliances Association.

By contrast with the sluggish room air conditioner market, the heating ventilation air conditioner market, an important part of the overall air conditioner market, will boom, Frost & Sullivan said.

China now has the largest heating ventilation air conditioner market in the world. It is also the largest manufacturer of such products. The top three Chinese manufacturers, Haier, Midea and Gree, can supply 50 percent of the world's demand for heating ventilation air conditioner products, Frost & Sullivan said.

Heating ventilation air conditioners are sold in the commercial and industrial fields. Their use has been expanded to be applied in the metro and high-speed railway industries. In 2011, China's heating ventilation air conditioner market was driven by a boom in China's commercial property, energy-saving policies from the 12th Five-year Plan (2011-2015) and in areas such as high-end real estate. It is estimated that China's heating ventilation air conditioner market was 50 billion yuan ($7.94 billion) in 2011, up 20 percent compared with the figure for 2010. It is predicted that the total market size will be 110.7 billion yuan in 2015, with a compound annual growth rate of 20 percent, according to Frost & Sullivan.

liwoke@chinadaily.com.cn