Crisis an opportunity for ROK's economic recovery

The Republic of Korea has been taking heavy economic blows following the dramatic collapse of its largest shipping company, Hanjin Shipping Co, and Samsung Electronics Co's decision to stop the production, sales and replacement of its fire-prone Galaxy Note 7 smartphones.

Hanjin, the world's seventh-largest container shipper, had a debt of more than $5.9 billion when it filed for bankruptcy protection at the end of August. Shares of Samsung, which accounts for nearly 17 percent of the country's GDP, plunged after it stopped the sales of Note 7, which cut $17 billion from its market value. And recent strikes at Hyundai Motor Co, the country's largest automaker, might deal another blow to the already struggling ROK economy.

On Oct 13, the ROK's central bank revised down next year's growth forecast from 2.9 percent to 2.8 percent. Its unemployment rate rose year-on-year to 3.6 percent in September because of a slowdown in manufacturing and export. Factory output in August, too, fell 2.4 percent from July, the fastest decline in 19 months.

The crisis haunting the ROK's leading enterprises, however, did not break out overnight. It was evident in the economic growth trajectory of the country, which has been struggling to pick up speed since 2012.

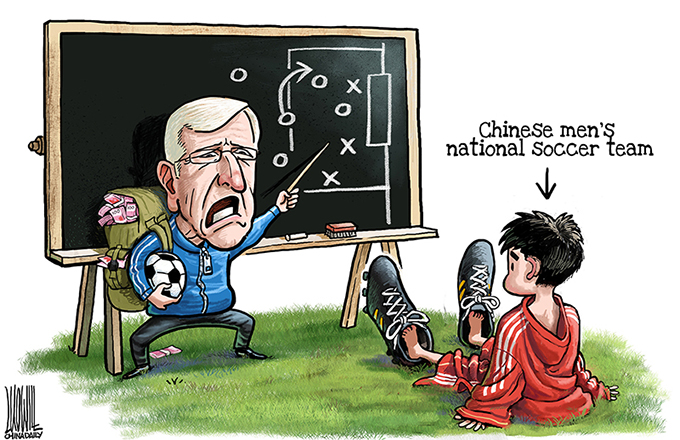

Exports, which make up more than half of the country's GDP, reportedly fell 5.9 percent year-on-year to $40.9 billion in September. The slow economic recovery in the West and China's slowing growth have prompted some ROK enterprises to put extra efforts into maintaining their global presence, but Samsung went a little too far and has learned a lesson in quality control.

The hurdles also include a government-led restructuring of enterprises and an anti-corruption law that some argue will hurt retailers and food producers. While seeking new economic drivers amid global economic woes, Seoul has taken measures to regroup enterprises at home to avoid more financial shocks. Getting rid of heavily indebted enterprises, which accounted for over 10 percent of the country's enterprises in 2014, is a step that has to be taken.

Moreover, plutocrats like Lotte Group conglomerate, whose chairman Shin Dong-bin was questioned by prosecutors on suspicion of embezzlement and breach of trust, are under stricter restrictions, as the ROK government has doubled its efforts to fight corruption. Plutocrats' total wealth made up about 84 percent of the ROK's GDP in 2012; the figure was just over 48 percent in 2003.

Worse, top positions in these "too-big-to-fall" giants are hereditary, which could lead to corruption, rigged competition and excessive expansion. The power and longevity enjoyed by industrial tycoons have greatly marginalized small and medium-sized enterprises, triggering increasingly bitter complaints against the plutocratic economy. The ROK government has thus rightly taken steps to change the situation, even though the magnates have made sizable contributions to the country's growth.

The crisis, however, can be turned into an opportunity for future industrial upgrade that could put the country in a better position to deal with economic turbulence. To begin with, the crisis should serve as a wake-up call for the ROK that addressing domestic economic problems is more important than deploying the United States' Terminal High Altitude Area Defense anti-missile system on the country's soil.

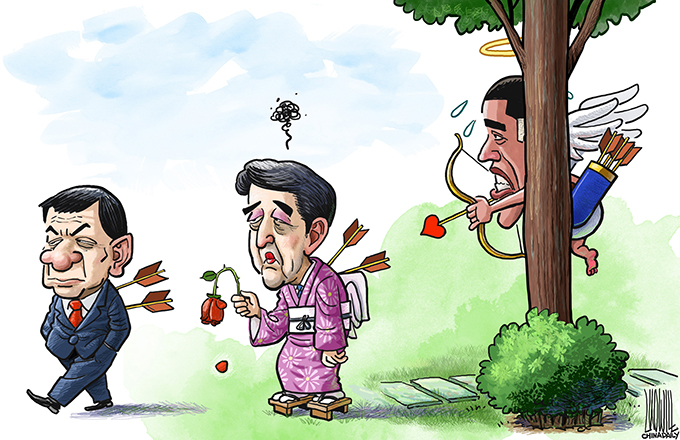

Also, deepening economic ties with Beijing is more than necessary for Seoul, especially because the ROK economy is highly linked with the Chinese market. So it is wrong for some ROK politicians to overstate China's slowing growth and underestimate the significance of the bilateral economic partnership.

The author is a researcher at the Northeast Asia Studies Institute at Jilin Academy of Social Sciences.