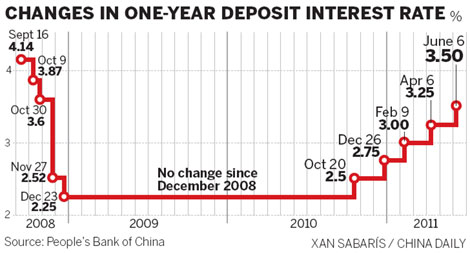

Third increase this year reflects resolve to fight inflation scourge

BEIJING - The central bank announced on Wednesday that it will increase interest rates, for the third time this year, by 25 basis points. The new rates take effect on Thursday.

The rate paid on one-year deposits will rise to 3.5 percent and the rate for one-year loans will rise by the same margin, to 6.56 percent, it said.

|

||||

The consumer price index (CPI), the main gauge of inflation, reached a 34-month high of 5.5 percent in May from 5.3 percent in April and the June figure could break the 6 percent mark.

There are pros and cons to raising interest rates, Guo Tianyong, an economist at the Central University of Finance and Economics, said.

"The rate hike is necessary to tackle inflation, although it will add to the economic slowdown and cause more speculative capital inflows."

The central bank's move was expected and there is still room for more hikes, said Ba Shusong, a senior economist at the State Council Development Research Center, a major think tank.

"It shows that curbing inflation will continue to be the major target of monetary policy," he said.

With different avenues available to raise funds, an over-reliance on credit control and increasing the reserve requirement for commercial banks - the amount they have to set aside - will have limited effect, he added.

The central bank raised the reserve requirement six times this year to mop up excessive liquidity and curb inflation.

Central bank adviser Xia Bin said that the rate hike of 25 basis points is "not enough", and more increases are needed to address the "negative interest rate" (compared to the inflation rate), according to Bloomberg.

He was echoed by Xu Xiaonian, a professor of economics and finance at the China Europe International Business School.

"The long-term gap between interest rates and the CPI will make inflation even worse," Xu said.

Inflation is predicted to peak in June, a three-year high, before tapering off in the following months.

The Agricultural Bank of China forecast that inflation could hit 6.4 percent in June, driven by soaring food prices and living expenses.

The National Bureau of Statistics is scheduled to release the June figure next week.

"Stabilizing consumer prices remains the top priority of macroeconomic regulation," Premier Wen Jiabao said during a visit to Liaoning province earlier this week.

The central bank reiterated on Monday that it will continue to maintain its "prudent" monetary stance and will use multiple tools to effectively manage liquidity and tame inflation.

But recent figures on factory output raised concerns over possible over-tightening and a hard landing for the economy.

The purchasing managers' index (PMI), a key gauge of manufacturing activity, fell to 50.9 in June from 52 in May, the slowest pace of expansion in 28 months. A PMI of 50 percent or greater indicates growth, while less than 50 percent indicates contraction.

The PMI for the non-manufacturing sector fell to 57 percent in June from 61.9 percent in May.

"Economic and financial development still face challenges," the central bank said.

Li Huiyong, chief economist at Shenyin & Wanguo Securities in Shanghai, said the second half of the year will see less monetary tightening as measures already introduced bite in.

The economy will maintain strong growth and the government still has plenty of room to tighten monetary policy, the World Bank said last month.

The economy is predicted to grow by 9.3 percent this year, before slowing to 8.7 percent in 2012 and 8.8 percent in 2013, it forecast in a report.

Xin Zhiming and Hu Yuanyuan contributed to this story.

Car limits 'upset the apple cart'

Car limits 'upset the apple cart' Wealth products lose appeal

Wealth products lose appeal Looser monetary policy expected

Looser monetary policy expected