Dozens of listed companies on the Chinese mainland reported receiving large government subsidies in the fourth quarter, which will help them improve their annual performance and even avoid delisting.

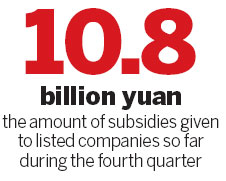

Eighty-one listed companies declared receiving 3.1 billion yuan ($497 million) in government subsidies in December, the Beijing News reported on Tuesday. A total of 10.8 billion yuan has gone to listed companies so far during the fourth quarter.

The subsidies are aimed at covering a variety of expenses, including technical improvements, relocations, environmental protection projects and tax rebates, the Securities Daily reported.

More than 90 listed companies received 3.9 billion yuan in subsidies at about the same period last year, according to the China Securities Journal.

Sun Lijian, deputy chief of the School of Economics at Fudan University in Shanghai, said that some companies desperately needed support as a result of the sluggish economy this year.

"Subsidies will help some companies stay alive, and also help keep employees' jobs, which is very important to local governments," he said.

However, Sun pointed out that some subsidies are going into "zombie companies", which are dying and do not have the potential to rebound.

Subsidies will support some companies' upgrades, or temporarily relieve financial pressures, said Ma Yao, a macro-economy analyst with CI Consulting, an industry research institution.

"But if subsidies go too far, it just shows local protectionism. Governments are trying to make the financial results of local companies look better," he added.

Moreover, some companies are using subsidies as a means to avoid delisting.

If a listed company is performing poorly in the market, it should accept restructuring or delisting, and local governments should not interfere, Yao said.

Ye Tan, a well-established economic commentator, said earlier that many listed companies will seek financial support from local governments to keep a shell company in the market and continue to raise money in the next year.

Meanwhile, because the number of listed companies is often considered a criterion in evaluating the competence of a local government, these governments have a track record of moving in to keep favored local employers out of trouble.

The biggest subsidy this month went to Chongqing Iron & Steel Co Ltd. The company announced on Thursday that it has received 500 million yuan from the Changshou district of Chongqing city as a relocation subsidy.

The company saw a loss of 1.4 billion yuan last year, and has seen a loss of 1.17 billion yuan in the first three quarters of this year.

Hareon Solar, a Jiangsu-based solar technology company, announced on Tuesday that it has received 206 million yuan from the local government. The company saw a loss of 199 million yuan in the first three quarters.

xieyu@chinadaily.com.cn

Related Readings

New rules on delisting

Two companies delisted from Shenzhen bourse

Stock delisting procedure on track

Exit from start-up exchange takes effect

KIA launches 2014 Cadenza premium sedan

KIA launches 2014 Cadenza premium sedan

Kiwi cows arrive in Ningxia

Kiwi cows arrive in Ningxia

Harbin Int'l Ice and Snow Festival kicks off

Harbin Int'l Ice and Snow Festival kicks off

Overseas yuan gets nod in mainland PE market

Overseas yuan gets nod in mainland PE market

World's largest spokeless Ferris wheel under construction

World's largest spokeless Ferris wheel under construction

Blazing a trail in the workplace

Blazing a trail in the workplace

Antique car investment set to boom in China

Antique car investment set to boom in China

Super sports car makers to ignite passions on the mainland

Super sports car makers to ignite passions on the mainland