|

|

International luxury brands in China are meeting the challenge of a market slowdown with greater efforts to improve the quality of customer service and the overall customer experience.

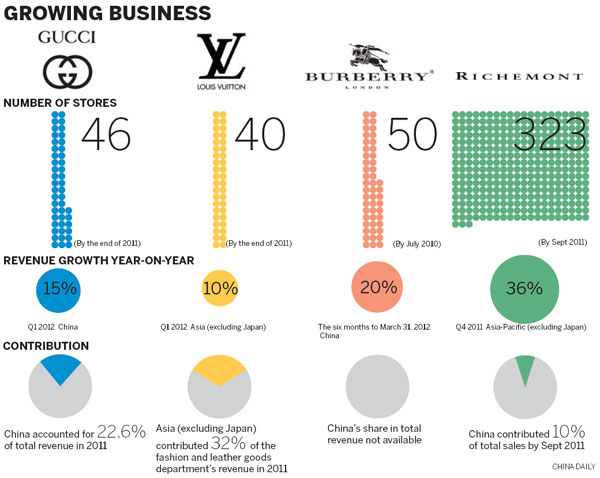

Gucci plans to open 10 new stores in China this year, after opening 12 last year. The number of Gucci stores in the mainland increased from four to 46 between 2004 and the end of 2011.

"Yes, the rate of expansion will be slower than in the previous years," Patrizio di Marco, president and CEO of Gucci, told China Daily.

Some other luxury brands, including LV and Chanel, will also slow their expansion in China starting this year, business analysts said.

Rather than just expanding their stores in China, the leading luxury brands are starting to pay more attention to upgrading their current stores.

Despite the slowdown, Gucci will relocate and enlarge some of its stores in China.

"It's not (store) numbers, it's how you engage with your customers that counts," Di Marco said.

Luxury brands' slowing expansion is one of the reasons behind China's luxury market growth slowdown this year.

"International luxury brands are cautiously optimistic about the future of China's market, because of uncertainty in the whole economy," said Bruno Lannes, a partner at the US-based consulting firm Bain & Company.

The growth of China's luxury market will be about 20 percent this year, down 10 percentage points from last year, according to a Bain report.

The first-quarter report issued on April 18 by LVMH, the world's leading luxury products group, showed that Asia excluding Japan did not rank among the top three growth regions for the group's fashion and leather goods department, which includes Louis Vuitton, Fendi and Marc Jacobs.

During the first quarter, revenue in Asia grew by around 10 percent, while the region accounted for 32 percent of the department's revenue last year.

Stacey Cartwright, chief finance operator of Burberry Group Plc, said on April 17 that the brand's revenue in China grew 20 percent from last September to March, but the rate was 30 percent between last September and December.

Rising inflation and depressed securities and real estate markets have affected Chinese middle-class income and consumption, said Zhou Ting, executive director of the research center for luxury goods and service at the University of International Business and Economics in Beijing.

"It is difficult to forecast how long the decline will last and maybe it is time for many luxury brands to change their strategy in China," Zhou added.

"The Chinese market is evolving very fast and we need to be able to react to that changing market," said Patrizio di Marco, who said that is one of the challenges for Gucci in China.

"Fortunately, we already established a large market share here," he said. "Our objective is now to consolidate our market share."

More products and shopping channels will be a way that Gucci takes to keep its consumers.

Gucci plans to launch e-commerce at the end of the year, allowing Chinese consumers to buy from Gucci's official website

Gucci will open more stores targeted at male customers and children, Di Marco said.

Luxury brands are now faced with the challenge of meeting more demands from customers.

High-end consumers, especially in big cities, do not just follow the well-known brands and require more personal products, said Zhou Ting.

"Scenes of Chinese consumers rushing into luxury stores for big names will diminish in big cities," she said.

In addition to luxury goods, high-end consumers want a better shopping experience, she added.

International luxury brands' after-sales service in China has long been criticized for its absence or the difficulty in obtaining services such as cleaning and maintenance.

"The weakest link may be the easiest one to change," Zhou said.

After-sales services have an important role to play in changing Chinese consumers' attitudes toward luxury brands, she added.

Gucci has already taken steps in this direction with the launch of its customer service hotline in the mainland in February.

Compared with the big names in the luxury industry, some niche brands are continuing to enjoy rapid growth in China this year.

Bottega Veneta, a luxury fashion brand which is famous for its understated elegance, saw its revenue rise by 45 percent in Asia excluding Japan in the first quarter of 2012, according to its parent company's revenue report released last week.

wangwen@chinadaily.com.cn