More taxation reform will stop capital flight

That China's largest automobile glass-maker Fuyao Group will invest $600 million to build a 2,000-worker factory in Moraine, Ohio, should set off alarm bells, prompting the Chinese government to lower taxes and operational costs for manufacturing industries to prevent the drain of Chinese capital and jobs.

Responding to the criticisms against his investment abroad in a recent interview, Cao Dewang, chairman and founder of Fuyao Glass Industry Group in Fujian province, complained about the heavy tax burden in China. Cao, who started investing small amounts in the United States in 1995, said it took him more than 20 years' observation to make the "prudent" decision two months ago, because there is an obvious gap in production and operational costs between China and the US.

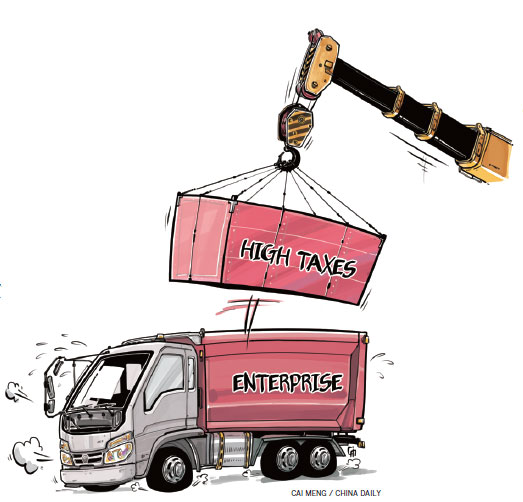

Tax on enterprises, electricity tariff and natural gas costs in China are all higher than in the US, he said. And compared with a number of fees an enterprise has to pay for land-use rights in China, land is almost free to use in the US thanks to local subsidies.

The high cost of production for and the heavy tax burden on manufacturing enterprises are facts many in China already knew. But it is Cao who first highlighted that in China they were not just high, but much higher than in the US.

At the recently concluded Central Economic Work Conference, the central government pledged to lower taxes, fees and element costs to foster the development of the real economy.

So Cao's remarks, immediately after the conference, should be able to spur the authorities in charge of reform to put their words into action.

Although China has deepened economic reform by taking a series of concrete measures since late 2012, the production and operational cost for enterprises, element price, labor cost and institutional transaction cost have increased, instead of declining.

All costs finally go into the products' retail prices that consumers eventually pay. So, many enterprises, including well-established ones, will either have to accept the loss of their competitiveness as buyers opt for alternative products with higher cost performances, or they can choose to relocate to overseas destinations where the production cost is lower and the business environment better. In fact, many Chinese enterprises have moved their production bases to foreign economies, especially Southeast Asian countries, in recent years and this trend is likely to gather pace in the future.

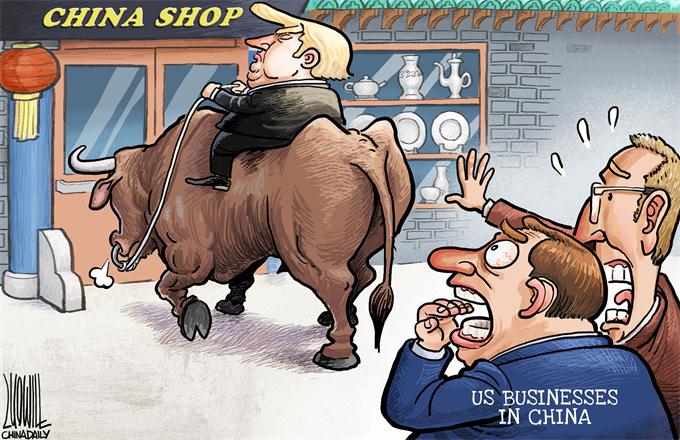

Because of its re-industrialization strategy, the US government seeks to attract manufacturing industries, including foreign ventures, back to the country, as they are not only important taxpayers but also job generators.

If the cost gap Cao has talked about is true, Chinese people should not lament the shifting of Fuyao Group's production unit; instead, they should appreciate the fact that many Chinese enterprises have not moved to the US.

The government has made some breakthroughs in the tax structural reform. But that's far from enough. The enterprise tax rate in China is still markedly higher than in developed countries. So the government should not only see how much tax it has cut, it should also see how much could still be cut.

US president-elect Donald Trump has vowed to lower enterprises' tax from 35 percent to 15 percent. The Chinese reform authorities should show the same sense of urgency to protect Chinese capital and enterprises. Behind the tax reform is a deeper-level reform of the government itself as well as the national administrative system.

The author is a Beijing-based financial columnist. The article was first published in Beijing News on Thursday.

(China Daily 12/24/2016 page5)