Fed sends shock waves with rate hike schedule

|

|

A Chinese clerk counts US dollar and renminbi banknotes at a bank in Huaibei city, East China's Anhui province, Jan 22, 2015. [Photo/IC] |

The US Federal Reserve raised the benchmark interest rate by 25 basis points on Wednesday, and indicated there could be three more hikes next year. The announcement triggered immediate fluctuations in global currency, bond and stock markets.

It is not this hike that has unsettled the markets, as this has long been anticipated and priced in; it is the Fed's proposed pace of hikes next year.

Although the Fed has been known for being changeable in making interest rate decisions, its proposed accelerated interest rate hike cycle for next year will have major repercussions for the global economy.

Historically, an interest rate hike by the Fed is accompanied by a rise in the value of the dollar, which in turn leads to massive international capital flows across borders in search of greater gains. This can undermine the financial stability of other countries. US interest rate hikes were one of the major contributors to the eruption of the Asian financial crisis in the late 1990s and its own sub-prime mortgage crisis in 2008.

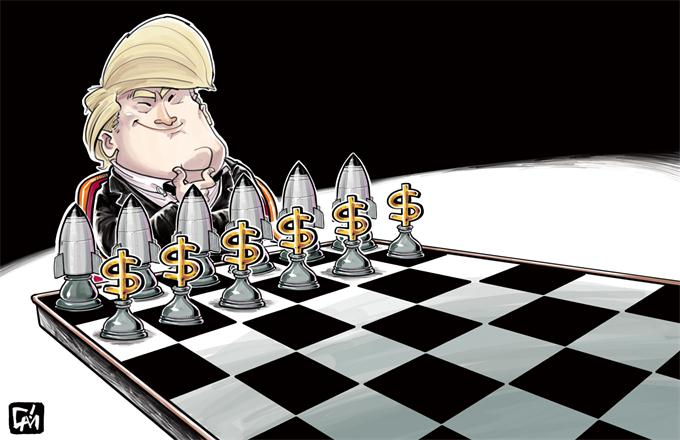

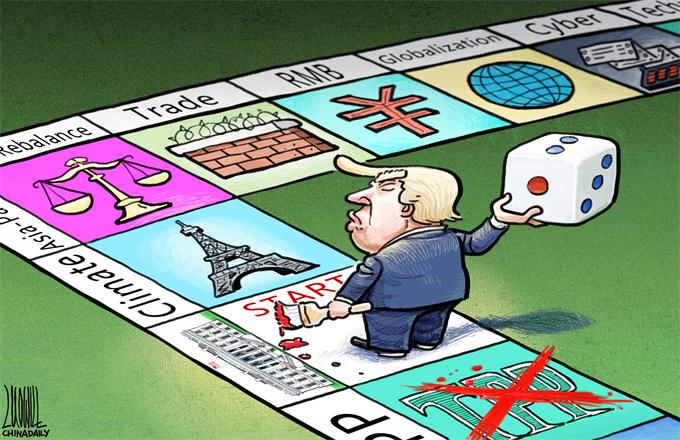

If the Fed raises interest rates three times next year, it is predictable that there will be more turbulence in the global financial markets that will affect emerging-market economies the hardest at a time when they will also be facing the challenge of the inward-looking trade policies that Donald Trump has been promising to introduce when he enters office.

Given the huge clout US monetary policy has on the global economy, it is to be hoped the country's policymakers take heed of the potential spillover effects of its monetary policies and coordinate with other countries to minimize any adverse impacts.

Especially since the global economy has yet to shake off the fallout from the financial crisis that originated in the US eight years ago, and the United Kingdom's withdrawal from the European Union that will bring fresh uncertainties.

While the US has enjoyed relatively strong growth momentum and the Fed expects that to continue, other countries are still struggling.

As Janet Yellen, the Fed chair, acknowledged on Wednesday, "we are operating under a cloud of uncertainty at the moment and we have time to wait to see what changes occur and to factor those into our decision-making as we attain greater clarity."

Bearing that in mind, the incoming US administration should avoid any beggar-thy-neighbor policies and instead look to the big picture, because any economic woes in other parts of the world will affect the overall world economy, ultimately undermining its own efforts to turbo boost the US economy.