Consumption versus investment

As China enters a new phase of economic development, doubts are being raised over its ability to maintain a reasonable enough growth to join the ranks of advanced economies. To do so, it is often said, China should replace investment with consumption and learn lessons from other countries how to avoid the so-called "middle-income trap".

Both contentions are somewhat misleading. Investment should slow down, but not much or at least not precipitously. More importantly, its efficiency has to increase to support consumption. Regarding international experiences, there are no ready-made lessons that China can learn from. Instead, it will have to rely on homegrown solutions to achieve advanced economy-level living standards. Here is why.

The so-called "middle-income trap" is a misnomer unless "middle income" is defined against some norm. If we take the per capita GDP of the United States as a benchmark and track other countries' convergence toward it over the past 60 years, four different groups emerge.

The first group is of the advanced economies whose per capita income has converged with one another and toward that of the US. The second group largely comprises Eastern European and Latin American countries, which started broadly at a similar level as those in the first group but got derailed midway, and made only partial recovery. In the third group are countries that managed to break away from the low-income group and succeeded in converging partly to the US' per capita income level. The last group consists of low and middle-income countries that have started getting close to the US per capita income level, but only in the last decade. China belongs to this last group.

A quick review of these economies' experiences shows political stability and sound governance are necessary conditions for convergence. Indeed, poor governance in Latin American economies, as manifested in corruption and income inequality, and political instability in Eastern European economies are often cited as factors that prevented them from becoming advanced economies. The ones that managed to break away are very few such as South Korea and Taiwan province of China. In both economies, the main contributors have been the combination of huge investment and a matching rapid pick-up in exports.

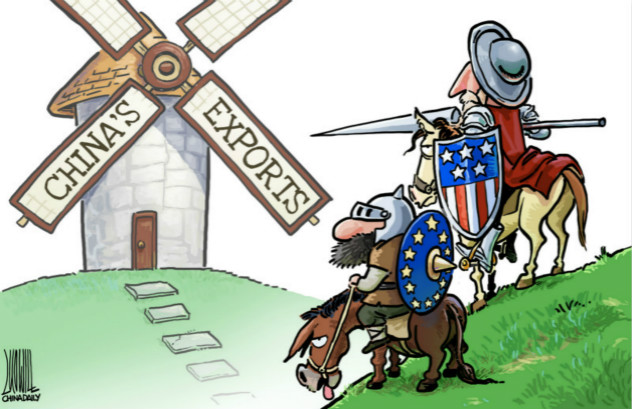

This is also the model China has successfully followed. However, the Chinese economy has become too large to fit the model, and external demand will remain sluggish in the wake of global financial crisis. Besides, investment is becoming increasingly inefficient at a time when financing constraints are tightening. Already, China's investment level, close to 50 percent of GDP, is about 10 percent higher than that of other Asian economies before the Asian financial crisis.

A sudden reduction in investment, however, is not the answer because it will pull down consumption as well. This would be the case especially in inland regions, where investment has become increasingly excessive. In these regions, private consumption is dependent on investment (rather than vice-versa) and the impact is relatively short lived, necessitating ever-higher levels of investment to maintain economic activity.