Mooncakes fall foul of fairer taxation principle

|

|

A worker displays Disney-themed mooncakes at a store in Shanghai earlier this month. Tang Yanjun/China News Service |

The Mid-Autumn Festival is approaching. To celebrate the festival, it is customary for some institutions and companies to give employees mooncakes, which is considered conducive to team building and enhancing employees' sense of belonging. So media reports that tax will be levied on mooncakes has aroused public concern.

Why are the taxation authorities considering imposing a tax on mooncakes considering it won't "earn" much money for the authority? Although the revenue from individual income tax has increased rapidly in recent years, the overall amount of individual income tax still accounted only for 7.93 percent of China's overall tax revenue in 2016.

In fact, there's no specific rule or regulation to stipulate mooncakes should be taxed, but according to the law "material object earnings" should be taxed.

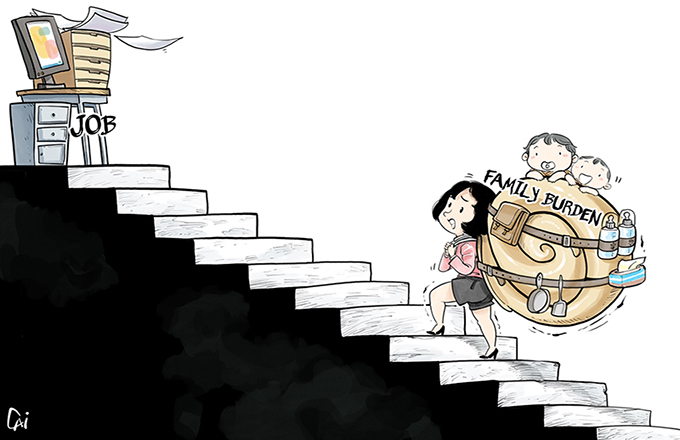

The reason that the taxation department taxes material object earnings is to guarantee individuals with equal incomes share equal taxation. For instance, if one person's monthly income is 20,000 yuan ($2,998) in cash, while the other person's monthly income is 10,000 yuan in cash and some commodities provided by their employer that are worth 10,000 yuan, it is unfair to impose different levels of taxation on them.

If the taxation department only imposes tax on cash income, the person receiving cash and commodities will have less of a taxation burden than the person receiving only cash, even though they have the same income. A fairer taxation method is to convert the value of the commodities into cash, and then impose taxation on this part of the person's income as if it was cash.

But it's a misunderstanding that commodities will also be taxed. According to the State Council's regulation on implementing the law on individual tax, material objects, including mooncakes, should be taxed according to their face value. But in practice, it is the value of material objects plus any cash minus deductible items, above the tax threshold of 3,500 yuan a month that will be taxed.

In another words, there's no specific "mooncake tax". No matter what kind of material object earnings an individual has, these objects will be treated like cash income for tax purposes.

Some local taxation departments have reiterated that imposing a tax on mooncake given by the employers is in accordance with the tax law and regulations, but many people still consider it excessive. Actually a slight revision to individual income tax could easily solve this problem. For instance, if the individual income tax stipulates a certain amount of tax exemption for the material object earnings given by employers as welfare for their employees, it is easy to get a win-win situation. An ordinary mooncake costs 200 to 300 yuan at most, which won't lead to taxation inequality.

The author is a research fellow at the National Academy of Economic Strategy, Chinese Academy of Social Sciences.