|

|

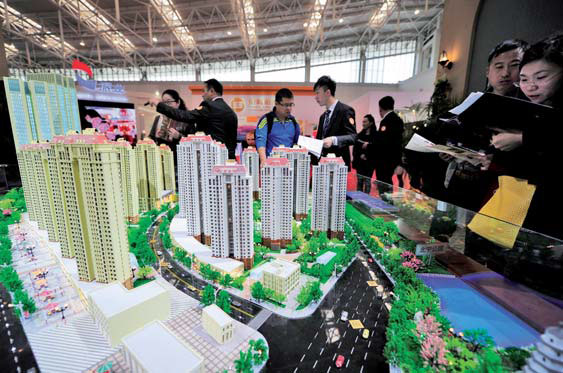

Property investment in China rose by 6.2 percent in the first three months of this year. [Photo provided to China Daily] |

The push for government-driven investment and economic stimulus is being reconsidered after the drive was launched few years ago.

Just as officials of the National Development and Reform Commission (NDRC) respond to economic concerns, do not expect new round of stimulus policies. What enterprises really need to do is to undertake de-capacity and upgrade the industrial structure.

But what’s behind this change? Is there no room for investment to fuel growth? Obviously, it’s not the investment itself that is the issue here. The problem lies in how to use the investment as a tool scientifically, said Tan Haojun, council member of China's Private Economic Development Association, commented with China Economic Net.

The lessons China could learn from the previous 4 trillion yuan ($614 billion) stimulus package is that capital should flow to the real economy. The goal of the stimulus package was to aid coherent growth not only to boost investment and consumption, but also to increase productive investment, government and private investment. While the fact turns out that though the stimulus accelerated economic recovery, it also brought out relatively low-speed development of enterprise investment and productive investment, especially in private sector.

The industries that have claimed to have achieved accelerated growth are actually focused on certain areas of economy such as real estate and underground finance.

Investment could function as a powerful tool to boost economy, even in the 21 century, if used properly. Otherwise the central government would have never launched polices targeted at fixed-asset investment in 2003. What went wrong was the decontrolling of the property market, which provided opportunities to earn windfall profits. That made distribution of social resources distorted, and it also allowed the existing social resources to flow back to fictitious economy, while leaving the real economy “hollowed out”.

The proper and sustainable way to let investment function well is to let capital flow into real economy, and the central government should guide the companies to carry out transformation and to lay more emphasis on technological innovation. Though monetary high may lead to problems such as inflation and costs of companies rising, but the employment and income growth brought by the real economy could counteract the possible negative influences.

So provided that investment could be guided and focused on real economy, and the local government’s impulse to unreasonably expand urban construction and land revenue could be restrained, investment, would still hold its irreplaceable role in the country’s economic development. More supervision is needed to facilitate the real economy, enterprises and private investment to play bigger roles.

( Wu Zheyu organized from China Economic Net )

I’ve lived in China for quite a considerable time including my graduate school years, travelled and worked in a few cities and still choose my destination taking into consideration the density of smog or PM2.5 particulate matter in the region.