|

|

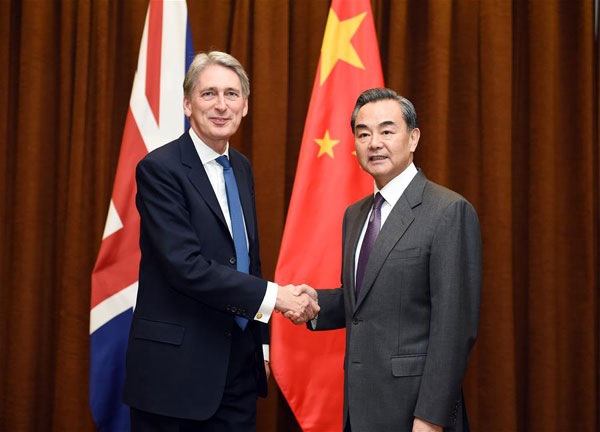

Chinese Foreign Minister Wang Yi (R) meets with British Foreign Secretary Philip Hammond in Beijing of China, Jan 5, 2016. [Photo/Xinhua] |

As a global society, we're obsessed by initials, but MES, the latest set, hides a serious dispute between East and West that is threatening to turn the old order upside down.

Let me try to explain. MES stands for "market economy status", an economy in which investment, production and distribution are all driven by the demands of the market.

It's these three initials which hide a growing dispute between China and the United States, with the hapless European Union trapped in the middle.

The US has argued for years that China has not yet fulfilled the criteria to be granted formal market economy status, while China argues that since it joined the World Trade Organization in 2001, it was accepted that MES would follow as a matter of course. In addition, China argues that the market liberalization measures it has adopted in its transition from a centrally controlled economy to a socialist market model means that the time has come.

The EU, fairly predictably, hasn't yet made up its mind, under pressure as it is from the US not to grant MES to China. And that's where the United Kingdom steps into the picture.

As far back as 2004, the UK indicated it would support China in its bid to gain MES.

And this is where it gets interesting. Ever since the dark days of World War II, the UK and the US have enjoyed a "special relationship", a phrase coined by wartime UK prime minister Winston Churchill. (Mind you, he also spoke of two cultures divided by a common language!).

That means that by and large, the UK has followed and been supportive of the US, with one or two exceptions. The low point for many was when former British prime minister Tony Blair joined forces with the US to invade Iraq, an ill-judged adventure that still resonates and caused critics to dub Blair "George Bush's poodle".

The re-emergence of China as an economic power on the world stage has meant a serious reappraisal in London of its ties with Washington. Don't forget Britain and China go back a long way - some of it good, some bad. But the relationship has survived, and in the words of Chinese and British officials, entered a "golden era".

The UK's pragmatic approach means, for example, that last year it was the first Western power to become a founding member of the Asian Infrastructure Investment Bank, a Beijing initiative that is seen as vital to regional development and China's Belt and Road Initiative linking Asia and Europe.

The US was hugely put out, seeing the AIIB as a challenge to the World Bank, which it has controlled ever since its inception.

Now the UK has again signalled it won't be bound by special ties by embracing the idea of China gaining MES this year. UK Chancellor of the Exchequer George Osborne's visit to China last autumn sent a firm signal that then UK was behind China's bid to gain MES, whatever its old ally across the Atlantic felt. I wouldn't be surprised if a quiet deal has been struck - unwavering British support for Chinese MES in return for serious investment in key British industries.

The US, which I believe is inherently protectionist, blames cheaper Chinese products for the diminution of its car industry and the collapse of its once-huge steel industry.

Until China gains MES, its products are still subject to huge anti-dumping fines.

The EU may well take a decision this year - German Chancellor Angela Merkel, although beset by domestic problems, has indicated she would give conditional support.

China's economy is on track to eventually overtake the US' in the next few years and that, I suspect, is what rankles in Washington.

Well, as they say here, get over it. Embrace reality and move forward.

The author is managing editor for China Daily in Europe. chris@mail.chinadailyuk.com