Realty policies continue

The latest statement from the State Council on house prices indicates that the government may not take drastic measures to dampen the real estate sector. Instead, it will keep policies stable so long as property prices do not soar again.

The State Council, at an executive meeting chaired by Premier Wen Jiabao, released a statement on Wednesday stating that it will expand the property tax program, which is being piloted in Shanghai and Chongqing municipalities, and continue its price control policies.

Claiming that existing policies have effectively reduced speculation and stabilized house prices, the statement shows the government is satisfied with what has been achieved so far.

While the statement broadly repeats policies announced in the past years, it sends a signal that new price control policies will be initiated if house prices rise unchecked.

In other words, whether policies change will to a large extent hinge on the trend of the property market in the first half of this year.

The statement is a due response to the public call for stabilizing home prices. Data of both private research bodies and the official National Bureau of Statistics have been on a rising trend since late last year.

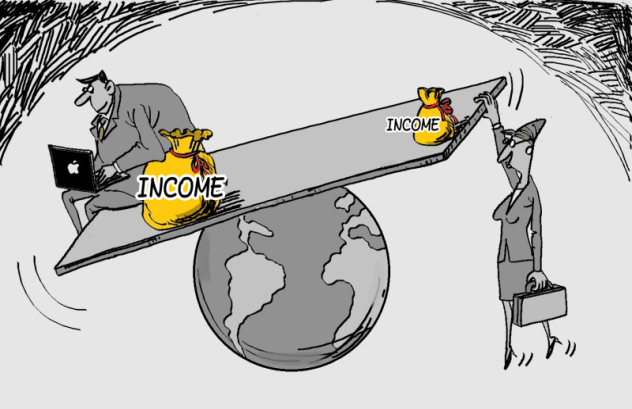

Given the already high property prices - they are estimated to have risen by about 10 times in major cities in the past decade, the government has few cards to play to balance stable economic growth and affordable housing.

The real estate and related sectors contribute an indispensably large proportion of local government revenues and national fixed-asset investment. It will pose great risk to the national economy if house prices drop drastically due to government tightening.

The public's complaints will grow louder, however, if prices continually rise.

Caught in a dilemma, the government has few options but to quicken the restructuring of the national economy and reduce its dependence on the real estate sector while increasing the supply of subsidized housing for low-income earners.

By the end of 2015, for example, there should be about 36 million units of so-called guaranteed housing, or low-priced affordable homes, available nationwide, accounting for as much as 30 percent of the total housing market, according to the government blueprint. Only then is the market likely to become more balanced.