The push for financial reform in the country will lead to a freer market

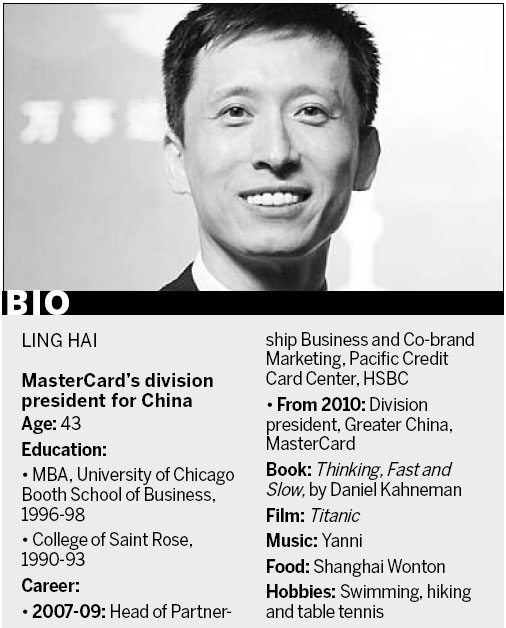

As China's consumer spending continues to grow, financial institutions must be given leeway to adjust credit card interest rates to remain competitive, says Ling Hai, MasterCard's division president for China.

With credit card interest rates locked in at 18.25 percent, Ling, who was a guest speaker at the recent Young Leaders' Forum in Beijing, says static rates lead banks to offer credit only to those with the best credit scores, which is a limited number considering the Chinese only began using credit en masse in the past decade.

"There are a lot of people in China who have no credit history, so how do you make a lending decision?" Ling says.

"Banks can't really do risk-based pricing, so what they end up doing is going after only the very credit-worthy, the good credit customers.

"If someone has no credit history, or a poor credit history, the banks want to take them, but they want to charge 25 percent. They can't do that right now."

Ling says the young generation of Chinese marks a big change in the way the nation views spending on credit.

"For my parents' generation, borrowing money was almost a crime. My generation is already different," the 43-year-old Shanghai-native says, as he takes his wallet from the side pocket of his suit jacket.

Offering a brief glance at the contents, he flashes a handful of credit cards - all bearing the MasterCard logo - before continuing.

"Then if you look at the people born in the 1980s or 90s, they have this tremendous optimism about the future. They believe they're going to make more money, have better jobs, more income and more wealth."

Animated and wearing an unshakable smile, Ling appears to share such optimism.

The use of credit cards is a fairly recent phenomenon in China. Very few credit cards were issued in the early 1990s but, by the end of 2012, more than 318 million were in use, according to the People's Bank of China.

That's a big number for any country but, with 1.4 billion people, China is a very under-penetrated market, Ling says.

"By comparison, the US has about 300 million people but the number of credit cards issued is more than 1 billion.

"China is still a very under-leveraged society. People hardly borrow anything."

With an MBA from the University of Chicago Booth School of Business, Ling observed firsthand the US' affinity for purchasing on credit.

While the optimistic mindset among younger Chinese is great for credit card companies, there should also be a note of caution, he says. "You have to strike the right balance in terms of debt."

But for foreign financing companies aiming to take a cut of China's newfound willingness to spend on credit, the focus is on striking the right balance with regulators.

Restrictions on foreign financial institutions operating in China have limited companies such as MasterCard, Visa and American Express to process cross-border transactions, purchases made with Chinese cards overseas, via dual logo partnerships with China's only domestic bank card network, UnionPay.

Before working at MasterCard, Ling played a crucial role in helping to establish such co-branded cards while working for Pacific Credit Card Center, a joint venture between HSBC and China's Bank of Communications.

While seven or eight years ago, simply being able to bring a card that worked with Chinese banks to process payments outside China was a step in the right direction, Ling believes bigger changes are afoot.

"Based on the recent framework from the Third Plenum, I think China is definitely moving in the right direction. That is, more opening, deepening reforms and also allowing a level playing field for both domestic and foreign companies, State-owned enterprises and private ones," he says.

With much of his time spent working closely with Chinese industry regulators, Ling believes the right mindset is in place to see an opening-up of China's domestic bankcard market.

"China sees competition as good. They understand that competition is what fosters innovation and allows better goods and services to be provided for people at a much lower cost.

"The market is really at the cusp of opening in terms of domestic opportunity; it's just not clear what the timing will look like. So I think we will just have to be patient."

Already there have been signs of an attitude shift with US-based Citibank being given the green light to issue its first single-branded cards in China in April.

Commercial focal points created by urbanization are also helping to set the stage for foreign finance service companies' first big moves into China.

China's population shift from rural villages to big cities is helping to create an environment from which financial services can effectively map out plans to expand, Ling says.

"If you look at rural areas, everything is spread out. There's no scale effect to build commerce and therefore there's no scale effect to take electronic payments.

"But with urbanization you have the concentration of merchants, you have the scale and cost efficiency to build electronic payment acceptance.

"More people will have jobs, better incomes and more wealth. Therefore they will become more credit-worthy for the banks to lend to them and issue credit cards."

Getting access to capital, whether for a person or a small or medium-sized enterprise, will be the driving force behind China's future economic innovation, he says.

"To succeed or flourish, businesses must meet consumers' un-met needs," he says. "Traditionally, businesses have had more leverage but, in the near future, consumers are going to be the ones with leverage."

Model with modified Audi A5

Model with modified Audi A5

Model with German luxury cars

Model with German luxury cars

Getting in the mood

Getting in the mood

Models at Mercedes pavilion at 2013 Auto Guangzhou

Models at Mercedes pavilion at 2013 Auto Guangzhou

Buick Riviera concept car at 2013 Auto Guangzhou

Buick Riviera concept car at 2013 Auto Guangzhou

FAW-VW all-new Golf at Guangzhou auto show

FAW-VW all-new Golf at Guangzhou auto show

VW donates more than 5k child safety seats

VW donates more than 5k child safety seats

Honda models at 2013 Guangzhou auto show

Honda models at 2013 Guangzhou auto show