When Xingquan International Sports Holdings sought a listing on Bursa Malaysia, the Malaysian stock exchange, it was welcomed with open arms.

The 2009 initial public offering (IPO) of China's fifth largest outdoor sportswear manufacturer marked the first by a foreign-owned company after a concerted 16-month effort by the Securities Commission and the stock exchange to internationalize the Malaysian capital market.

The Fujian-based company's July debut was followed closely by Multi Sports Holdings, a shoe sole specialist that designs, develops and manufactures shoe soles, which listed in August. Three months later, sports shoe and sportswear manufacturer XiDeLang Holdings made its IPO.

Hopes were high that the arrival of these Chinese companies would improve the efficiency of the Malaysian capital market, add depth and breadth to the exchange and pave the way for local investors to access stocks from the world's most dynamic economy. Bursa Malaysia, a latecomer to the game, would finally catch up with the likes of Singapore, New York and London in courting cross-border listings from the economic superpower.

In a win-win situation, Chinese companies were accessing funds much faster than on home ground, where a massive backlog could delay listing aspirations for up to five years and intensify competition for investment dollars.

Xingquan International tells China Business Weekly it had decided on a Bursa Malaysia listing because of encouraging support from the authorities and local financial institutions and funds.

"We explored several options back in 2008 and found the Malaysian market to be most suitable for us with strong attention at that point in time," says Wu Qingquan, the executive chairman and CEO.

But the rosy picture has not panned out as planned.

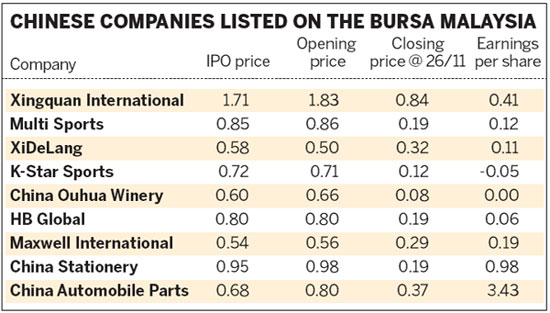

There are nine listed Chinese companies on the Malaysian exchange: Xingquan International, Multi Sports, XiDeLang, K-Star Sports and Maxwell International Holdings are involved in design and manufacturing of shoes and sportswear; China Ouhua Winery Holdings produces and distributes wines; HB Global is a gourmet convenience food specialist; China Stationery manufactures plastic stationery products; and China Automobile Parts Holdings (CAP) manufactures chassis components used in automobiles.

They made mostly modest debuts on Bursa Malaysia. Except for CAP, which opened at 18 percent higher than its IPO price. The others recorded opening price premiums of no more than 10 percent. XiDeLang and K-Star Sports even started below their retail offer prices.

"We had hoped for a better reception. Perhaps the investment community needs more time to understand our company and the market that we are in - and evaluate us differently from the rest," says Wu.

The companies have also lost considerable value since listing. As at the close on Nov 26, their share prices were well below their IPO prices. Xingquan International and CAP, for example, are trading at less than half of their IPO prices.

The dismal performance of the entire category has been largely blamed on negative perception and poor investor sentiment, precipitated by accounting scandals involving some Chinese companies listed in Singapore, Hong Kong, Canada and the United States.

Edmund Tham, head of research at Mercury Securities in Kuala Lumpur, can see another reason for their poor stock performance.

"The financial results of some of these Chinese companies have also not been so good," he notes.

Model with modified Audi A5

Model with modified Audi A5

Model with German luxury cars

Model with German luxury cars

Getting in the mood

Getting in the mood

Models at Mercedes pavilion at 2013 Auto Guangzhou

Models at Mercedes pavilion at 2013 Auto Guangzhou

Buick Riviera concept car at 2013 Auto Guangzhou

Buick Riviera concept car at 2013 Auto Guangzhou

FAW-VW all-new Golf at Guangzhou auto show

FAW-VW all-new Golf at Guangzhou auto show

VW donates more than 5k child safety seats

VW donates more than 5k child safety seats

Honda models at 2013 Guangzhou auto show

Honda models at 2013 Guangzhou auto show