Though respondents think property price hike will continue in next 2 yrs

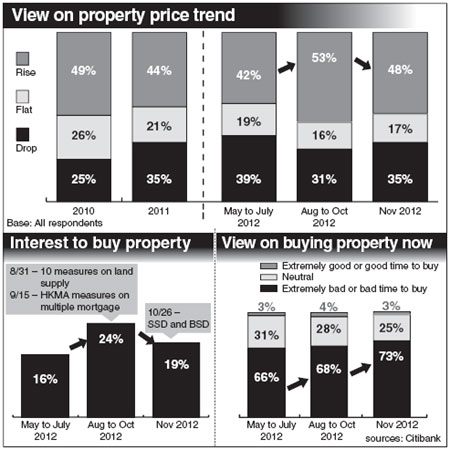

More than two-thirds of the respondents of a local home ownership survey think it is extremely bad or simply bad timing to buy properties now although nearly half of them think the local home prices will continue to rise in the next two years.

According to the survey, 48 percent of the respondents perceive that local property prices will still soar in the next two years, an increase of six percent on the 42 percent respondents who had a similar view during an earlier survey conducted in May. Another 19 percent of the respondents indicated that they are very/quite interested to purchase properties compared to the 16 percent recorded in May.

|

|

The property ownership research commissioned by Citibank interviewed 2,126 adults, aged from 21 to 60 years old, from May 22 to Nov 5 based on random sampling.

However, regarding whether the respondents will buy properties now, 73 percent of them said it is extremely bad or simply bad timing to buy properties in the current market. Respondents with a neutral view of the property market shrank from the 31 percent in May to 25 percent in November. Only 3 percent of the respondents regarded the present as an extremely good or good time to buy a home in the city.

"This result shows that local home buyers, although being bullish on local home prices, are more realistic than in the 1990s when confronting the home purchase issue. We think this will be good for the local home market to have a long term healthy development," said Lawrence Lam, Director of Sales and Secured Lending at Citibank Global Consumer Group.

The Centa-City Lending Index, tracking the local home price movement, rose to 116.07 on Nov 4, representing an 11.61 percent hike from May 27 this year. This means that local home prices have jumped 11.61 percent during the six-month period when the interviews were conducted.

According to the CCL, local home prices had swelled 21.58 percent as at Nov 4 from the start of this year.

"Local home buyers are mainly deterred by the recent government measures in making home purchase decisions," Chinese University of Hong Kong Institute of Global Economics and Finance Professor Chong Tai Leung told China Daily. "Global and local macroeconomic factors in the last few months has not really changed very much to affect home buyers' decisions."

The Hong Kong government in late October unveiled the strongest-ever restrictive measures to rein in soaring home prices by introducing the 15 percent Buyer Stamp Duty on non-local home buyers and all local or overseas corporate buyers.

The government also extended the special stamp duty restrictive period from two years to three years. It also raised the SSD tranches as home owners will be slapped with a SSD of 20 percent, 15 percent or 10 percent, respectively, if they resell their flats within six months, one year, or two years of purchase, respectively. Home owners will be waived the SSD payment after three years of purchase.

Both the BSD and SSD are calculated based on the property purchase prices or the property market value at the time of resale.

oswald@chinadailyhk.com

Sichuan becoming traffic hub of W China

Sichuan becoming traffic hub of W China

Mandarin festival attracts tourists

Mandarin festival attracts tourists

Dawn of China's foreign trade recovery

Dawn of China's foreign trade recovery

October export growth accelerates, imports steady

October export growth accelerates, imports steady

Hainan Airlines eyes more overseas investment

Hainan Airlines eyes more overseas investment

Views and hopes from top executives

Views and hopes from top executives

E-retailers brace for massive promotion for Nov 11 event

E-retailers brace for massive promotion for Nov 11 event

Those who deliver warmth in winter

Those who deliver warmth in winter