|

Manufacturing activity increased in July, albeit at the slowest rate in eight months, while another gauge, focusing more on small and medium-sized enterprises, recorded the largest increase in nearly two years.

The two readings suggest a stabilization, and analysts expect the economy to pick up in the next five months.

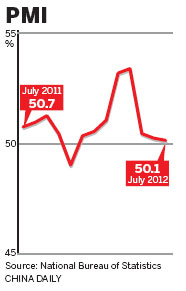

The official purchasing managers' index in July, a key gauge reflecting operational activity in the manufacturing sector, stood at 50.1, according to the National Bureau of Statistics and the China Federation of Logistics and Purchasing on Wednesday.

It was lower than the market consensus of 50.5, and was a slight drop from 50.2 in June. A reading above 50 indicates expansion and beneath, contraction.

A separate PMI reading, by HSBC, which mainly focuses on small and medium-sized businesses, indicated a slowing deterioration with a reading of 49.3 in July, up from 48.2 in June, the largest month-on-month increase in 21 months.

The official PMI figure is based on data from 820 companies in 31 industries. Large enterprises generated a PMI of 50.3 last month, a decline from 50.6 in June. Small-scale businesses recorded a figure of 48.2, against 47.2 for a month earlier. This figure has remained below 50 for four consecutive months.

"Production and construction always slow down in July," Lu Zhengwei, chief economist with Industrial Bank, said.

He was confident that the outlook would improve soon, a view shared by the China Federation of Logistics and Purchasing.

Sub-indexes, gauging production, new orders and employment, all fell by 0.2 points from June, highlighting downside risks, according to Huang Yiping, chief economist for Asia at Barclays Capital.

"The risks may come from a deteriorating European situation, which has been dragging down US growth, and less effective or insufficient domestic policy support," Huang said.

The International Monetary Fund said last week that China's economy will rebound in the second half of this year to expand 8 percent in 2012 as government policies to spur growth take effect.

Entrepreneurs in East China's Zhejiang province, a regional export powerhouse, remained concerned.

"There is no obvious sign that the amount of orders from European countries will increase soon," said Li Zhongjian, the manager of Wenzhou-based Zhejiang Tung Fong Lighter Industrial Co Ltd.

Overseas orders in July fell by 20 percent compared with June and are expected to drop further in August, Li added.

Large industrial enterprises saw profits drop in June for the third consecutive month amid sluggish demand, NBS data showed on Friday.

Many companies are seeking to upgrade and streamline operations but this has met resistance.

Research conducted by global consultancy company McKinsey & Company found that only one third of the companies succeed in the endeavor, with resistance from employees and outdated management attitudes cited as major obstacles.

"For example, in many cases, it is not the technology bottleneck but management incapability that hinders the upgrade of companies," said Zhang Haimeng, partner with McKinsey in China.

China's slower growth has had consequences for Asia. The Republic of Korea's exports declined sharply year-on-year in July with consumer prices increase at their slowest pace in more than 12 years.

"Final manufacturing PMI confirmed only a modest improvement of manufacturing conditions thanks to the initial effect of the earlier easing measures," Qu Hongbin, chief economist in China with HSBC, said.

Currently, the country's job market is facing increasing pressures, highlighted by both the official and HSBC figures.

"As the labor market is a lagging indicator of economic cycles, a further deterioration in employment conditions remain possible," a report from HSBC said.

The government has been aware of the potential risks and started to take measures.

These include slashing interest rates in July, for the second time in a month and lowering the amount of funds banks must keep in reserve.

At a key meeting attended by the top leaders on Tuesday, the government pledged to cut taxes and maintain moderate credit growth while beefing up support for major projects and implementing policies that allow private capital to play a bigger role.

A research note from Barclays Capital said that the central bank is expected to cut interest rates in the third quarter.

Contact the writers at chenjia1@chinadaily.com.cn,

weitian@chinadaily.com.cn and yuran@chinadaily.com.cn

AFP contributed to this story.

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions