|

|

|

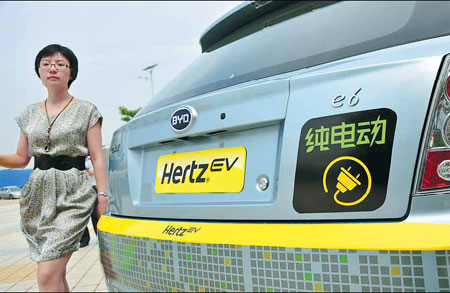

A woman with her rented electric car from Hertz Car Rental in Shenzhen. Beijing-based China Auto Rental now is the country's largest vehicle-leasing agency, measured by fleet size. The company has postponed its public listing in the United States. [Photo / China Daily] |

Guo Zhong was a dedicated fan of backpack travel for more than 10 years. After leaving high school, he covered five continents on foot, each time lugging his huge, yellow rucksack. Yet, things changed when he started work as a marketing manager in Shanghai.

"Now I prefer to randomly buy a plane ticket to a city for a weekend and then rent a car at the airport and loaf around aimlessly," said the 31-year-old. "I can get a real feel for a place on the road."

With the emergence of car rental services, he said many of his friends now take similar holidays.

China's vehicle-leasing sector, which advertises itself as offering flexibility and convenience, has enjoyed boom times in recent years, aided in part by rising living standards and curbs on private cars in large cities such as Beijing and Shanghai.

The demand has led to fierce competition, with the two market leaders aggressively expanding to grab a greater share.

After receiving venture capital investment in 2010, China Auto Rental Inc and eHi Auto Services Co Ltd are continuing their fundraising this year.

In March, the parent company of Enterprise Holdings, the world's largest car rental company in terms of revenue and fleet, announced it had reached a global affiliation agreement with eHi.

The deal, which included a 15-percent stake in the Shanghai-based company, gives Enterprise Holdings representation on the board of directors, marking the United States company's entry into China.

"At eHi, we focus on meeting customer needs by delivering convenience and reliable services," said Zhang Ruiping, its founder, chairman and CEO. "We're excited that Enterprise Holdings has chosen to invest in our future growth, and this partnership is an endorsement of our credibility as a leading car rental operator in China."

Greg Stubblefield, executive vice-president and chief strategy officer for Enterprise Holdings, said: "We're excited to invest and partner with a market leader in China like eHi. Under this agreement, not only are our customers assured of a high level of service when trav-eling in China, but eHi's customers also will be introduced to our award-winning and friendly service globally."

Analysts said the investment is more likely to boost Ehi's ambition than money raised from the stock market, due to a gloomy global financial environment. Moreover, the partnership will cover business development, knowledge transfer and strategic planning to leverage Enterprise Holdings' 55 years of success. Ehi's customers will also have worldwide access to the US company's portfolio of brands, including the international airports of Los Angeles, San Francisco and Vancouver.

In exchange, Enterprise Holdings will offer Ehi's services to its business and leisure customers during their time in China, including in Beijing, Shanghai, Guangzhou and Shenzhen.

The deal could prove a challenge for China Auto Rental, the country's largest vehicle-leasing agency in terms of fleet size, and the only one offering services in every province and autonomous region.

Headquartered in Beijing, the company announced in January that it planned to raise $300 million to repay debts and buy vehicles through an initial public offering on the New Work Stock Exchange. Then, in April, the company revised its application to the US Securities and Exchange Commission, saying it had changed the destination to the Nasdaq.

China Auto Rental said it expected to offer 11 million American depositary shares at a price of $10.50 to $12.50 each.

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions