Record high coal stocks coupled with falling demand by secondary industries including mining, manufacturing and construction, will cut the danger of power shortages this summer, according to the National Development and Reform Commission.

Releasing figures which showed May power use in Shanghai and the provinces of Hubei and Jiangxi all fell, and power use in six cities and provinces including Chongqing, Liaoning, Jilin, Zhejiang, and Gansu increased by less than 3 percent, Lu Junling, a deputy inspector at NDRC, said compared with previous years, this year's expected electricity deficit will be much lower, although it could still grow under extreme weather conditions.

"The largest power supply shortfall is expected to be around 18 million kilowatts at the country's peak this summer, accounting for less than 3 percent of the maximum electrical loads," said Lu.

He added that power shortages during peak months of the year are a common problem among electricity generators around the world, including those in developed economies.

The latest data from the National Energy Administration showed China's coal stockpiles in major power plants increased by 48.3 percent to 93.1 million metric tons by June this year, representing a record high which is enough for 28 days use.

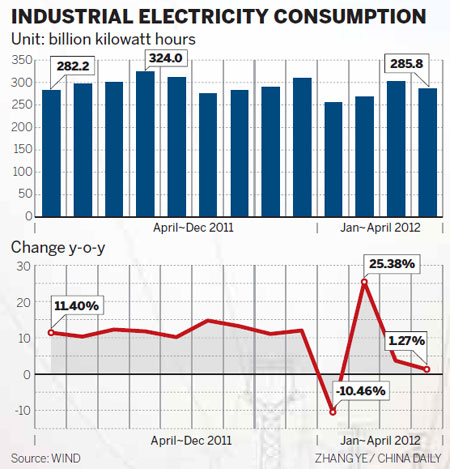

NEA said that for the first five months, China's power use reached 1.96 trillion kilowatt-hours, a 5.8 percent increase year-on-year, and 6.2 percentage points less than the growth a year earlier.

Lu said weak demand by secondary industries particularly mining, manufacturing and construction had mainly contributed to the slowdown of national power use.

From January to May, electricity use by secondary industries grew 3.8 percent year-on-year, a 7.9 percentage points drop from the same period last year.

Accounting for 73 percent of the total amount, secondary industries dominate the country's national power use, with metallurgy, non-ferrous, chemical and building materials the main consumers.

Rising just 3.5 percent, weak power use in the metallurgical and building materials industries pulled down the country's total electric use growth, according to NEA figures.

"The smaller power shortage this year is to a great extent due to economic downward pressure, slowing growth of some power-intensive industries and sluggish market demand at home and abroad," Lu said.

He added that as the world's biggest energy consumer, China should stick to its existing industrial upgrading, energy conservation and emission reduction targets, within its overall economic growth module.

The NDRC, the country's top economic planning agency, has been working alongside the NEA and other government agencies to strengthen efforts at trimming peak energy loads to better manage electricity power supply and demand, a clear barometer of China's economic condition, said Lu.

Despite the all-time high inventory, coal will remain the mainstream of the country's energy supply, the NEA added on Wednesday.

Coal inventories at Qinhuangdao, China's major coal transfer port, are reported at record levels, passing 9 million tons, up more than 50 percent from a year earlier.

"Coal demand will increase during power peak use this summer, but we have flexible supplies, which guarantee the national power demand," said Wei Pengyuan, deputy head of the NEA's coal department.

China's hydro-power production has now moved out of negative growth for the first time in seven months. In May hydro output rose by 36 percent, reducing demand for thermal coal by 8 million tons.

During the 12th Five-Year Plan (2011-15), China plans to achieve coal production of 4.1 billion tons annually.

The coal industry will experience balanced development in the long term, as economic growth rebounds, added Wei.

baochang@chinadaily.com.cn

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions