|

|

|

Iron ore being loaded for shipment to iron and steel mills at Qingdao port in Shandong province. Demand for iron ore is declining as the country's economy slows. [Photo/China Daily] |

China's commodity inventories are building up rapidly, indicating that demand for power and steel is slowing as the economy cools.

As of Wednesday, coal stockpiles stood at 8.7 million metric tons at Qinhuangdao port, China's biggest coal port in Hebei province, up 40 percent year-on-year, statistics from Wind Information show.

"The inventory level is the highest so far this year," said Xiao Xinjian, industry analyst at the Energy Research Institute, which is affiliated with the National Development and Reform Commission.

"But destocking will begin as electricity demand peaks," Xiao said.

Summer is usually China's peak electricity season, when air conditioner use surges.

China is the largest consumer of thermal coal, which contributes 70 percent of the country's power generation.

Power use has been growing slowly as industrial activity weakens. But customs statistics show that coal imports skyrocketed 90 percent year-on-year in April, as international coal prices fell faster than domestic ones.

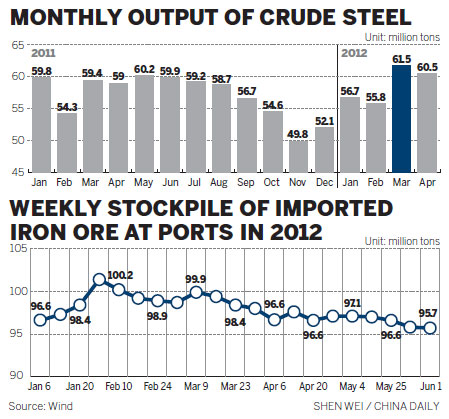

Inventories of iron ore, a raw material for steel production, are also running at high levels partly because of slowing demand for steel.

Iron ore inventories at China's major ports have surpassed 100 million tons, compared with 90 million tons last year, according to umetal.com.

The inventory of iron ore at Qinhuangdao alone amounts to 1.6 million tons, insiders said.

"Iron ore inventories at major ports have been building up since the Lunar New Year, which is quite unusual," said Wei Hongbing, president of Tianjin Harvest International Shipping Co.

These ports are almost out of space for storage, Wei added.

"The grade of domestic iron ore is declining, leading to the growing need for more imported iron ore," said Zhang Jiabin, research director at umetal.com.

"In the long run, we anticipate a gradual increase in the iron ore stockpile," Zhang said.

Prices of coal and iron ore have also decreased, with coal prices down for four weeks in a row. Increasing commodity inventories signal slower GDP growth this year, experts said.

A report from Bank of America Merrill Lynch said China's second-quarter GDP growth rate may drop to 7.6 percent from the previously expected figure of 8.5 percent, and the figure for the whole year is likely to be 8 percent, down from the earlier forecast of 8.6 percent.

The figures were 9.2 percent in 2011 and 10.4 percent in 2010.

Meanwhile, the purchasing managers' index, a gauge of manufacturing activities, fell to 50.4 in May, down 2.9 percentage points from April, according to figures released by the China Federation of Logistics and Purchasing.

The data added to evidence of slower growth in the world's second-largest economy as Europe's debt crisis continues eroding overseas demand and China's curbs on real estate have an effect on more sectors.

Premier Wen Jiabao warned last month that the economy is facing increasing downward pressure. The government has pledged to put more focus on growth and will actively boost domestic demand.

Zhang Xiaomin in Dalian and Xie Chuanjiao in Qingdao contributed to this story.

liuyiyu@chinadaily.com.cn

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions