Overseas M&As a concern

Overseas mergers and acquisitions by Chinese enterprises have long been viewed as a positive part of China's opening-up to the outside world and a sign of domestic enterprises' growing strength.

However, the blind enthusiasm for overseas mergers and acquisitions among some domestic enterprises in recent years has raised concerns.

Statistics indicate that non-financial direct investment overseas made by Chinese enterprises totaled a record $170.11 billion in 2016, an increase of 44.1 percent year-on-year.

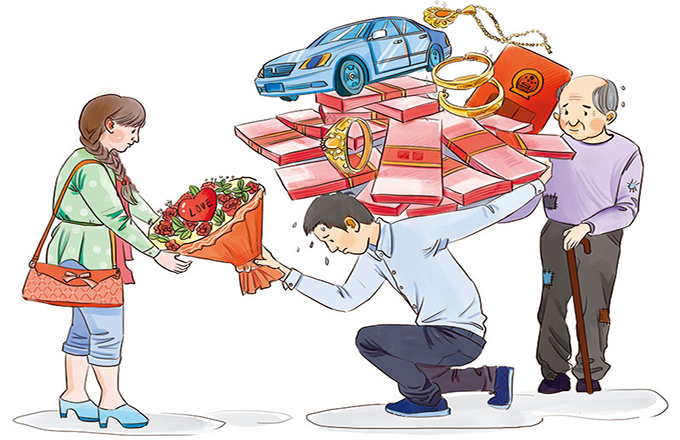

At the 2017 annual meeting of the China Development Forum on Monday, Pan Gongsheng, vice-governor of China's central bank and head of the State Administration of Foreign Exchange, expressed concerns about the drastic increase in outbound investment, comparing it to a thorny rose.

He cited such extreme cases as a Chinese iron and steel plant purchasing an overseas movie company and a Chinese restaurant chain buying an overseas online game company.

In the context of China's ever-deepening integration into the global economic system, mergers and acquisitions by Chinese companies overseas can not only facilitate China's economic transformation but also promote economic growth in the host countries.

However, some of China's outbound mergers and acquisitions last year were not made based on normal market principles, but made with the consideration of shifting some assets to overseas regions at a time when the yuan is depreciating against the US dollar. Aside from exhausting China's foreign reserves, such outward assets transfers, if left unchecked, will have inestimable negative influences on China's economy.

The drastic drop in the value of some European companies as a result of Europe's political turbulences in recent years may offer a rare opportunity for their acquisitions by Chinese enterprises. However, China is still a developing country and it should refrain from making any reckless moves to avoid economic losses because of misjudgments. Any overseas mergers and acquisitions should be made prudently and on a sound basis.