|

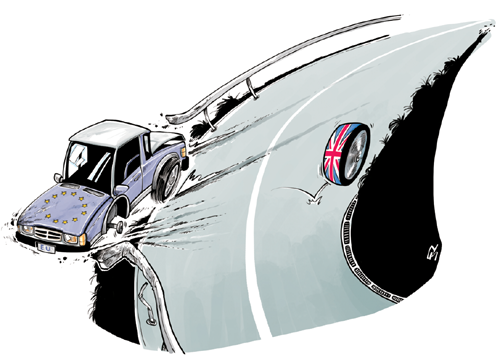

| Cai Meng / China Daily |

The referendum leading to the United Kingdom's exit from the European Union is a lose-lose outcome because the UK and the EU both will be weaker. China will have a less reliable partner as for the next two-three years as the UK will be totally preoccupied with the lengthy and complicated legal process to extricate itself from 80,000 pages of EU legislation.

The "Remain" campaign relied too much on the ability of British Prime Minister David Cameron to convince voters. But Cameron, who on Friday said he would resign in October, was caught up in the massive anti-establishment protest vote. Many voters simply did not believe Cameron's prophecy of doom if Britain voted to leave.

Then there was the reluctance of Labour Party leader Jeremy Corbyn to get involved. Traditional Labour towns in the north of England voted heavily for Brexit, influenced by the prospect of reducing immigration. The "Leave" campaign also had a catchy slogan "Take Back Control" implying that Britain had no control of its borders and very little control of what goes on in Brussels.

What happens now? The short answer is that nobody knows, except that there will be months and possibly years of uncertainty. Britain is likely to fall into recession. On Friday, the pound sterling fell more than 10 percent and billions of pounds were wiped off the UK stock market.

The "Leave" camp has no agreed plan of what new trading relations it should seek. During the campaign there were references to the Albanian, Canadian and Norwegian models. But whatever model it goes for, it will take years to negotiate. And Britain does not have its trade negotiators, as trade deals have been outsourced to the EU for decades. Nor is it in the EU's interest to allow the UK some slack lest it encourages other bloc members to try similar tactics.

Divorce from the EU will take a minimum of two years, and during this period the EU machine will be clogged up with legal processes. This will leave little time for foreign policy, including EU-China and UK-China relations.

Britain will also suffer political uncertainty. The Conservative and Labour parties remain badly split. The country is deeply divided, between different population groups and geographically, with London, Northern Ireland and Scotland voting strongly to remain in. At the very least, this raises the spectre of Scottish independence again. There are also concerns in Northern Ireland about the imposition of border controls with Ireland.

The direct impact on the EU will also be uncertainty and turmoil. Not only is the EU weakened globally, there are many practical but difficult issues to resolve: what will happen to the EU budget? What role is there for the UK in the EU during the negotiation period? How far is the UK able to influence the EU agenda in the interim, including, for example, on Transatlantic Trade and Investment Partnership?

Clogging the machine will make it less likely for the EU to be able to tackle the reforms needed to deal with the challenges and crises it currently faces. Populists everywhere-especially rightwing nationalists-will try to exploit Brexit by arguing that their countries should follow suit.

Some have suggested that the EU needs to make a leap forward after Brexit. But this is unlikely as there remain fundamental disagreements on financial and economic policy between Germany and the other eurozone members. With elections due in France and Germany next year there will be no major new proposals on the table. It may take years for the anti-European poison in the British political bloodstream to be removed. By then Britain will be a reduced power on the world stage, and a poorer partner for China.

China has made major investments in British infrastructure (nuclear plans, high-speed railway and airports) and hoped to see London as a major hub for the internationalization of the yuan. These plans will have to be reconsidered as the new British government seeks to assess its priorities.

The author is the director of the EU-Asia Centre in Brussels.