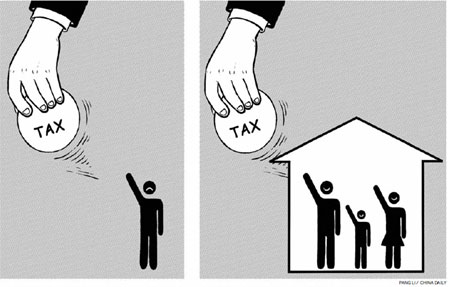

Plea for household income tax

Several tax experts have suggested that individual income tax be changed to household income tax to reduce wage earners' burden, and higher taxes be imposed on the high-income group to establish a fair taxation regime, says an article in China Youth Daily. Excerpts:

Household, not individual, income determines the living standard of a family. Therefore, it would be fair to tax people according to their household income. The biggest advantage of household income tax is that it takes into consideration the actual expenditure of a family and is thus a fairer method of taxation.

Cartoon/Pang Li

In countries that have a relatively mature tax system, the threshold of individual income tax is linked to economic indicators such as fluctuations in the consumer price index and other dynamic socio-economic shifts. For example, in Germany, while measuring a household's burden officials see whether it is a one-person, married-without-children or married-with-children family. They also take into consideration the amount the family spends on children's education and other necessary matters.

Although it is difficult to switch from individual to household income tax, it is not infeasible. Many experts and officials say China should follow international convention in terms of taxation, and it is time it did so by learning from the examples of other countries.

To reform the income distribution system and establish a harmonious society, China has to ensure social wealth is distributed in a fair and reasonable manner.

Some government departments reportedly have already taken the first steps toward tax reforms by setting up a network connecting between national and local taxation systems. Therefore, it is likely that social consensus will be reached in the near future on replacing individual income tax with household income tax.

(China Daily 09/25/2013 page9)