|

|

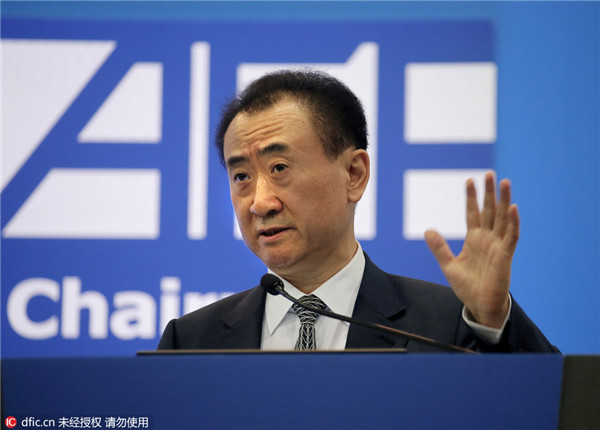

Wang Jianlin, chairman of Wanda Group, delivers a speech at the Ninth Asian Financial Forum in Hong Kong, on Jan 18, 2016.[Photo/IC] |

However, merger activity can have its challenges. Most analysts accept that the US, although a huge market, operates a series of regulatory hurdles, as well as a Congress that at times seems highly protectionist.

For example, a move by Chinese investors led by GSP Ventures to acquire an 80 percent stake in the lighting and auto unit of the Dutch company Philips fell through after the US Committee for Foreign Investment blocked the move on security grounds. Philips has several US government contracts.

"The United Kingdom and the US are equally important countries," Wang said. "I've invested $10 billion in the US because it is a big market, but the UK is the freest market in the world. The US claims to be a free country, but for investing, there are many complicated approval processes."

Still, the foreign merger route for Chinese companies continues unabated. Chinese companies look at mergers as a way of acquiring know-how to help the country in its transition from a focus on "made in China" to "designed in China".

"M&A deals are an important ingredient of China's State-driven transition and development strategy," said Danae Kyriakopoulou, senior economist at the Centre for Economics and Business Research in London.

"This is because Chinese companies need to acquire the know-how of the new growth sectors to support the economy's rebalancing away from being the world's hub for basic manufacturing and heavy industry and towards high-end economic activities, and M&A with companies of those more-developed economies in those sectors is a way to do that."