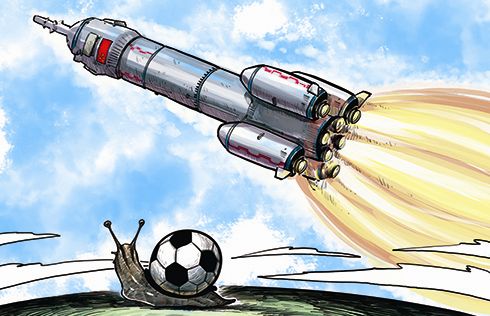

The flood of mortgage loans cannot lift all boats

China's steady economic growth in the third quarter has not only won precious time for the country to further boost domestic consumption and take up the slack for slowing trade growth. It also highlighted the limitations of a red-hot property market fueled by easy credit to drive overall economic growth.

Latest statistics showed that the Chinese economy expanded by 6.7 percent year on year in the past quarter. Although the third-quarter pace was only as fast as the previous two quarters, it is still a remarkable achievement for the world's second largest economy as the global recovery is increasingly troubled by slowing trade growth and lingering financial uncertainties.

The World Trade Organization recently cut its forecast for global trade this year to just 1.7 percent from its previous estimate of 2.8 percent in April. The new figure, the lowest growth rate since the 2008 global financial crisis, indicates a drastic slowdown in global trade that has fairly explained the strong headwinds China's trade sector faces.

As a result, China's foreign trade in the first three quarters shrank by 1.9 percent from a year earlier to only 17.53 trillion yuan ($2.61 trillion), with exports and imports down 1.6 percent and 2.3 percent respectively. This reconfirmed Chinese policymakers' judgment that the country can no longer rely on exports as a major growth engine that had served well to propel China's rapid rise as a global trading power since the beginning of this century.

It is obvious that the double-digit growth of domestic consumption has timely lifted the country's economic growth at a moment of tremendous downward pressures in other sectors. In spite of all the economic difficulties at home and abroad, China's retail growth climbed by 10.4 percent in the third quarter, 0.1 percentage point faster than that in the first half year, to ensure a steady growth of the overall economy.

Under such circumstances, it seems wise for the Chinese government to give more support to foster a sustainable domestic consumption upgrade.

Unfortunately, much needed bank loans and credit support have been granted to home buyers in the belief that soaring house prices will both encourage fixed-asset investments and help create a wealth effect that would drive consumption growth to bolster real GDP growth.

- China's economy better than expected: Premier Li

- Putting too many eggs in one basket is not good for the economy

- Chinese economy stabilizes but risks still lurk

- Investors better to remain coolheaded about Chinese economy

- Economy tackling challenges, growing within reasonable range: Central bank governor

- Chinese economy is stable: central bank official