Malaysia has much to offer investors

By Jin Rui ( China Daily )

Updated: 2013-10-05

Government policies

The nation's favorable tax rate and laws have attracted many investors from Japan, Saudi Arabia, Singapore, China, South Korea, France, Norway, India, Netherlands, Germany and many other countries in the world.

Companies like Dell, Intel, Sony, Samsung, Panasonic and Samsung have settled in Malaysia as well.

Malaysia has adopted a series of tax policies that encourage foreign investment, which include:

1. Pioneer Status, PS: Company will be granted tax exemption on 70 percent of the statutory income for 5 years. The balance 30 percent of that statutory income will be taxed at the prevailing company tax rate.

2. Investment Tax Allowance, ITA: Company will be granted an allowance of 60 percent with regard to any qualifying capital expenditure incurred within five years from the date the first capital expenditure is incurred. The allowance can be utilized to set off (exempt) up to 70 percent of the statutory income in the assessment year.

The balance of that statutory income will be taxed at the prevailing company tax rate. Any unutilized allowance can be carried forward to subsequent years until the whole amount has been fully utilized. The policy mainly applies to manufacturing, agriculture, tourism and service industries.

3. Reinvestment Allowance, RA: This policy mainly applies to manufacturing and agriculture companies. The RA is given at the rate of 60 percent on the qualifying capital expenditure incurred by the company and can be offset against 70 percent of its statutory income for the year of assessment.

4. Accelerated Capital Allowance, ACA: After the 15-year period of eligibility for RA, companies that reinvest in the manufacture of promoted products are eligible to apply for Accelerated Capital Allowance.

The ACA provides a special allowance, in which the capital expenditure is written off within three years. For example, an initial allowance of 40 percent and an annual allowance of 20 percent. This policy applies to manufacturing and agriculture industries, as well as environmental management and telecommunication technology

5. Agricultural Allowance, AA: Agricultural companies, cooperatives and organization can apply for this allowance. Deductions are allowed on capital expenditures (agricultural allowance) for approved agricultural projects.

6.MSC Status: Telecommunication companies could have a 100 percent tax exemption after their information has been checked by Multimedia Development Corporation. It also allows unrestricted employment of foreign knowledge workers.

7. Operational Headquarters Status, International procurement Centers Status, Regional Distribution Centers Status: Aside from being allowed the 100 percent foreign ownership, the approved Operational Headquarters, International Procurement Centers and Regional Distribution Centers are also granted the 100 percent tax exemption for their earnings (up to 10 years) as well as other benefits.

Cooperation

Malaysia was the first ASEAN member to establish diplomatic relations with China. It has maintained close ties with China in politics, economics, cultural, education and many other areas.

From 1984 to 2012, Malaysia's investment in China has totaled $6.3 billion, including the renowned Parkson Supermarket by the Lion Group and the Shangri-La Hotel by the Kuok Brother Group.

The Chinese direct investment in Malaysia, on the other hand, has grown quite rapidly and the cumulative amount to date totaled more than $1 billion in 2012, $199 million of which was invested in 2012 alone.

The key projects of Chinese companies in Malaysia include a rubber plantation operated by Guangken Rubber Group, a telecom project by Huawei and an iron mill by Shougang Group.

Furthermore, Chinese companies signed 72 new infrastructure contracts with Malaysia in 2012.

The newly signed contracts include the land reclamation project at Mersing harbor by the Sinohydro Group, Telekom Malaysia's contract with Huawei, the new metro rapid transit construction in Kuala Lumpur by China Railway Group.

And with the support from Chinese government, China and Malaysia together built two industrial parks in 2012 and 2013.

These two countries have integrated their resources, technology, markets and capital to help accelerate the development of the whole region.

The author is an expert with the Chinese Academy of International Trade & Economic Cooperation.

Schedule

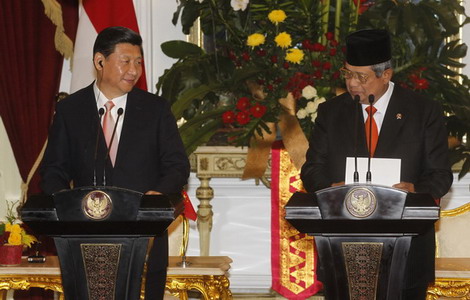

President Xi visits Indonesia, Malaysia, attend APEC summit

Oct 2 to 3: Pay State Visit to Indonesia

Oct 4 to 5: Pay State Visit to Malaysia

Oct 6 to 8: Attend the 21st economic leaders' meeting of APEC forum and meet with global leaders in Bali, Indonesia

Forum

China and ASEAN to handle territorial issues like friends

China and its neighbours should handle the issue of territorial claims as a problem between friends rather than a conflict with one another.

China should increase investment in ASEAN

China should ratchet up cooperation with Association of Southeast Asian Nations countries to expand Beijing's regional influence while countering Washington's Asia-Pacific pivot strategy.