Jiang said such a policy shift had prompted many investors to drop their expectations of any imminent interest rate cuts or of reductions in banks' reserve requirement ratio by the central bank.

Most analysts said they believed the market was unlikely to rebound to its previous high level for the rest of the year, as all positive aspects were already factored in and there were no "new forces" strong enough to act as a stimulus.

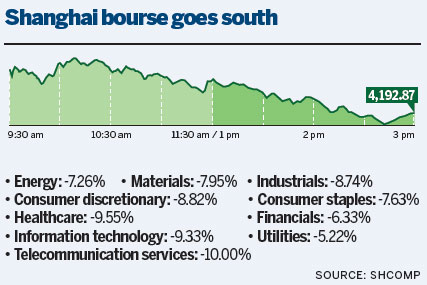

On Friday, China's securities regulator said the market fall was a "self-adjustment" after earlier excess gains. The Shanghai index had surged by nearly 150 percent in the past year until the recent correction. The regulator urged investors to treat the recent volatility rationally and said there was still "generally ample" market liquidity.

One investor in Beijing, who requested anonymity, said, "All my gains have disappeared in a week. I've paid the price for being too greedy and not leaving the market at the right time."

Foreign institutional investors have joined analysts in warning that valuations have risen too far.

Jonathan Garner, head of Asia and emerging-market strategy at US investment bank Morgan Stanley, said, "This is probably not a dip (in which) to buy.

"We think the balance of probabilities is that the top of the cycle on the Shanghai and Shenzhen markets and the ChiNext has now been reached."

But some analysts said they believed the boom in financial asset prices in China had not ended, as people would continue to shift their wealth from the property market to financial bourses because of limited investment options.

Jiang said the stock market appeared to have run out of steam for the rest of this year and investors may have to wait until next year for another rally.

Bloomberg contributed to this story.