During the first two months of 2015, China's exports to Russia dropped 27 percent from the previous year to $5.33 billion, according to statistics from the General Administration of Customs.

Many Chinese companies suffered great losses, with their business shrinking significantly. Some had even worse experiences, such as Russian buyers defaulting on commercial contracts, refusal to take delivery of goods in a timely manner, delayed payments and sudden requests for price reductions, said Wu Hongbo, a businessman who has been in the China-Russia freight industry for many years.

According to the textile commerce association in Wenzhou, East China's Zhejiang province, 1,664 companies in the city, which mainly produce shoes, clothes, socks or auto and motorcycle parts, are trading with Russia.

Russia is the third-largest market behind the European Union and the United States for shoes made in Wenzhou.

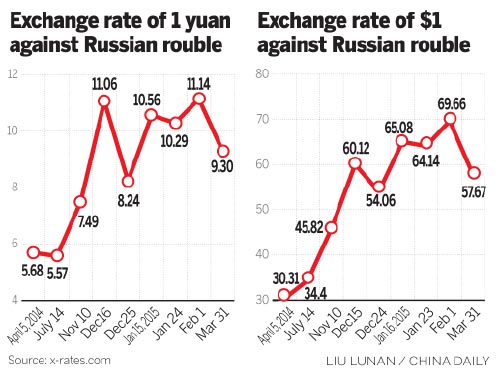

Shoe exports from the city exceeded 800 million yuan ($129 million) in 2013. But the devaluation of the rouble will have a great impact on consumption in Russia and further affect shoe exports from Wenzhou, which already declined significantly last year.

Zhou Dewen, president of an association promoting the development of small and medium-sized enterprises in Wenzhou, said the profits for merchants who went to Russia from Zhejiang province dropped by as much as 50 percent after the devaluation of the rouble.

With Russian households and businesses spending less, orders for certain light industrial products have decreased by 30 to 40 percent.

Yin Wenru, head of the foreign trade department at Wenzhou Bureau of Commerce, said companies taking orders should ask the other party to pay in dollars and pay in advance to reduce the risks associated with exchange rate fluctuations.

Geely Automobile Holdings Ltd issued a profit warning on Dec 16, saying that the consolidated net profit attributable to equity holders of the company for 2014 is expected to decrease by approximately 50 percent year-on-year.

The company said the drop in net profit is primarily because of the sharp decline in vehicle sales in some of its major export markets and the foreign exchange loss recorded by its subsidiary in Russia, caused by the abrupt depreciation of the rouble against the US dollar and the yuan.

Although the rouble's devaluation has created an unfavorable environment for China-Russia trade, experts said its impact will be limited due to the trade structure between the two countries.

"While mechanical and electrical products account for 60 to 70 percent of China's exports to Russia, more than 80 percent of Russia's exports to China are energy and raw materials. As these bulk commodities are dollar-denominated, most of China's imports from Russia will not be affected by the devaluation of the rouble," said Li Jianmin, a research fellow with the Institute of Russian, Eastern European and Central Asian Studies at the Chinese Academy of Social Sciences.

Li said Russia will deploy a strategy of export diversification to tackle Western sanctions and turn its sights toward Asian markets including China. This will provide new opportunities for trade cooperation between the two countries.

For instance, Russia has a shortage of certain oil exploration and aviation equipment due to Western sanctions. The Russian government is trying to develop its own manufacturing industry but is limited by its lack of technology, productivity and labor.

Therefore, China and Russia have broad prospects for cooperation in these fields, she said.

Guan Qingyou, head of Minsheng Securities' research institute, said that on the one hand, the rouble's depreciation-combined with the slowdown in Russia's economy-will have a negative impact on Chinese exports to Russia. On the other hand, it will benefit China as the drop in oil prices will lower the cost of its oil imports and help the country build up its own strategic oil reserves.

Huo Jianguo, former president of the Chinese Academy of International Trade and Economic Cooperation under the Ministry of Commerce, said the weakening of the rouble will spur Chinese investment in Russia as investment costs will be reduced.