China's central leadership approved the Decisions on Major Issues Concerning Comprehensively Deepening Reforms at the close of the Third Plenary Session of the 18th Communist Party of China Central Committee on Nov 12 in Beijing. The full text of the decisions, which was issued on Friday, heralds the most sweeping reform of the economy in more than 10 years, with policy breakthroughs achieved in areas of widespread concern, including investment access, a further opening-up drive, the financial sector, the public finance regime, the pension system and the family planning policy.

China will adopt a "negative list", and build a unified market access system with all market players able to enter equally and legitimately into areas that are not on the list. Corporate investment projects, except those related to national security, will no longer need government approval. This is testimony to the policymakers being well aware of the role the private sector can play in unleashing growth potential and preventing China from falling into the middle-income trap, a situation where a country moves from the low to middle-income level but thereafter gets stuck. In the medium term, private businesses will probably gain full access to about 80 to 90 percent of the areas currently under restriction and sustain rapid growth in the next decade.

There is a pledge to promote reform through further opening-up and cultivate competitive advantages in international cooperation. With investment access relaxed, the accelerated building of a pilot free trade zone in the country and further opening-up along border areas, China will probably consider participating in the Trans-Pacific Partnership negotiations. A projection based on quantitative calculation indicates that, with due reduction in tariff use among member states, China will record an average annual GDP growth rate 0.5 percentage points higher than that under the baseline scenario of China not joining the trade bloc.

As for reform of the financial sector, there will be accelerated market-based interest rate liberalization and capital-account convertibility, and qualified private capital will be able to set up financial institutions such as small-and medium-sized banks under enhanced supervision. That, together with the development of a multi-layered capital market, will create conditions for the private sector to acquire more financial resources. Meanwhile, the pledged liberalization of the capital account will help pave the way for further opening-up, improve the efficiency of China's asset allocation worldwide and boost the global clout of the Chinese currency. Other measures such as allowing local governments to issue municipal bonds are also conducive to defusing the risks caused by the debts of local financing vehicles.

The highlight in the reform of the public finance sector is that the State-owned sector will contribute 30 percent of its dividends to public finance by 2020, while at present, the proportion ranges from zero to 15 percent. This will allow people to better share the fruits of the State-owned sector and ease the pressure on public finance. Another highlight is that the decision calls for compiling charts of the assets and liabilities of central and local governments. Based on the charts, the general public can better supervise government spending and caution local policymakers against the risks of over-indebtedness. The formulation of asset and liability charts will also lay the foundation for local debt rating.

When it comes to the pension system, part of the State-owned capital will be used to beef up the social security fund and a road map will gradually be worked out for suspending the retirement age of employees. These two measures will guarantee the sustainability of the country's pension fund in the next 30-plus years. Although these measures will not bring tangible outcomes any time soon, they are part of the efforts to chart the course for national development in the long run, manifesting the quality of preparedness in China's policymaking.

Another forward-looking initiative is to allow couples to have a second child if one of them is a single child. It is estimated that thanks to this, between 2030 and 2050, China's average annual GDP is likely to grow at a rate 0.2 percentage points higher than the baseline scenario if China does not loosen the decades-old family planning policy. Compared with the scenario without any adjustment, the country will witness an increase of 40 million in the work-age population by 2050, which will cushion the decelerating impact the shrinking workforce is having on economic growth.

Finance, railways, the Internet and new energy sectors will be the major beneficiaries of the proposed reforms. For instance, the development of a municipal bond market will reduce the risks facing the banking sector, and a multi-layered capital market and the opening-up of the capital account will foster new growth opportunities for bond dealers; social security reform will expand the growth space for the insurance industry; the relaxation on investment access will enhance investment in railways and subways and facilitate their growth; opportunities will be created for Internet companies to enter the finance and telecommunications sectors; and the new energy sector is likely to benefit from and thrive amid the reforms of the fiscal and taxation system as well as the resource pricing mechanism.

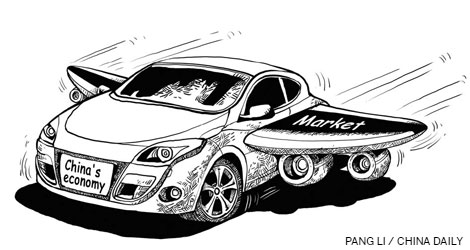

These reforms will fundamentally improve the Chinese market's efficiency in allocating resources, tap the potential for growth, reduce macro risks and sustain economic growth in the long run.

The author is chief economist, Deutsche Bank, Greater China.

(China Daily 11/20/2013 page9)