Tax distribution system reform is necessary

As the new Chinese government gets to work, people’s expectations for the overdue tax distribution system reform are high again. The new government should waste no time starting the reform, which will yield positive results and resolve many problems, says an editorial in China Business News.

Excerpts:

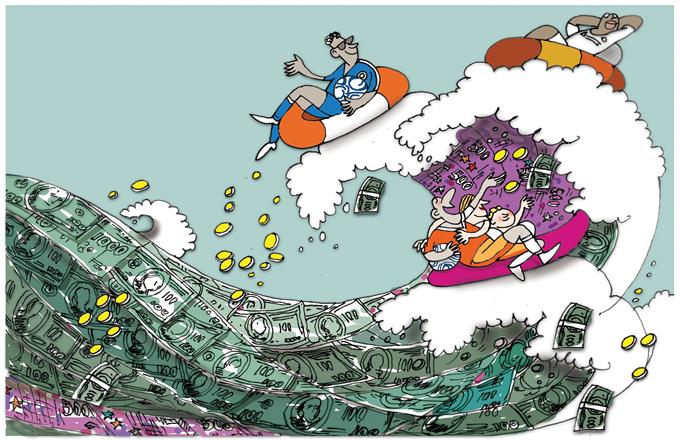

The current tax distribution system, created in 1994, between the central and local governments is very favorable to the central government, leaving local governments no choice but to seek more nontax revenues from land transfers and borrowing from banks to make ends meet.

As local governments are the main public-service providers, they deserve more tax revenues than their current share. Otherwise, it is impossible to bring down high housing prices.

Matching the government’s revenue with their duties should be the ultimate target of the tax distribution reform. The reform, for many people, is less risky and costly than many other reforms. There is also a social consensus about the need for the reform.

The main opposition comes from the central government. It relies on transfer payments to repay local governments. However, past experience indicates that the transfer payment system relies on the central government’s decisions. Yet, in practice, local governments have a much clearer understanding of local priorities for investment.

Thus it is more efficient for the central government to decentralize its financial resources to the local authorities and make more efficient use of national tax revenue.