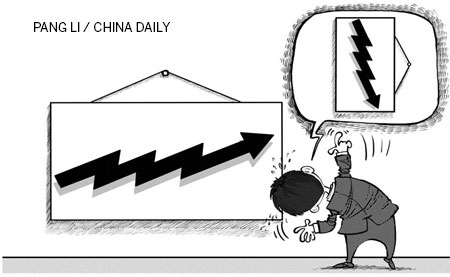

Changing expectations about a hard landing in China have produced dramatic fluctuations in market sentiments. Concerns about a hard landing had subsided just before the March GDP data came out: a 8.1 percent versus the market expectation of 8.3 percent. In the past, a difference of 0.2 percentage points would not have created much of a commotion. It is understandable, however, that with the European outlook clouded with uncertainty and US recovery tepid, markets are nervously watching China as it moderates from double-digit to single-digit growth. Our view is that China is unlikely to experience a hard landing and will ease into a somewhat lower growth trajectory.

During most of the 2000s, China's growth has moved broadly in tandem with the eurozone and the United States. Beginning in early 2009, however, China's recovery outpaced the others by a large margin, thanks to its comprehensive stimulus package. Then in 2011, as the advanced economies suffered a major setback, China again diverged with strong domestic demand largely compensating for declining exports.

This is noteworthy because domestic demand held up well despite the large withdrawal of monetary stimulus (total social financing fell by more than 10 percent in 2011 over 2010) and a tighter-than-anticipated fiscal policy stance (a deficit of 1.2 percent of GDP instead of 2.0 percent). The strength of domestic demand is founded on both investment and consumption. Non-government investment picked up sharply in 2011, which more than compensated for the declining government investment. Consumption also held up well throughout 2011 and increased further in the first quarter of this year even after adjusting for seasonality.

High frequency data on the demand side - including consumption per capita, retail sales, and non-government investment - all indicate resilience. While there is some doubt as to whether the high level of investment can be maintained throughout 2012, the rekindling of activity that is appearing in the property market could take up any slack in corporate investment. The picture is somewhat less optimistic on the production side. The data for heavy and light industry show a fall in industrial value added, and inventories have been rising in both upstream and downstream industries. This is, of course, not surprising given the weaker exports.

So, where does all this leave us? On balance, it does not appear likely that domestic demand will weaken any time soon. Most likely, economic activity will continue to be subdued for another quarter as exports bottom out and the negative impacts of last year's monetary and fiscal policies run their course. But this is conditional on the eurozone stabilizing and the US continuing to recover. Investment is expected to remain relatively robust, but most likely with a slight shift back from non-government to government investment. Some early indicators for April look promising, but it would be premature to conclude that China has already bottomed out.

What if domestic demand, especially consumption, is not self-sustaining once the pull from exports recedes during the course of this year? On the policy side, China still has sufficient fiscal space. Fiscal policy is expected to be neutral under the current status quo. However, if needs arise, providing a modest positive fiscal stimulus would not be difficult. On monetary policy, following the announced M2 path with fine tuning along the way to ensure adequate supply of liquidity would appear to be the right response. It is important, however, to further expand the scope of financial intermediation to ensure resources are efficiently allocated to all parts of the economy. In this regard, the initiatives in Wenzhou and Shandong province to promote private sector financing activities appear promising.

What if prices, especially food and necessities, continue to rise despite the slowing of the economy? While there was a rise in headline inflation in March, non-food inflation has been falling for a while. Furthermore, it does not appear that the economy's capacity is being fully utilized, especially in view of the large investment by the corporate sector in the recent past. There will continue to be monthly variations given the tight supply of agricultural products. We need to be mindful also that food prices - including cereals, vegetables, oils, meat, seafood, sugar and fruits - have been rising sharply worldwide since the mid 2000s. This reflects the adjustment of relative prices between food and manufactured products at the global level as the supply of the former lags behind demand, and the prices of the latter are kept low due to productivity increases.

To conclude, a hard landing in China appears highly unlikely. Even in the extreme scenario of a severe recession in Europe, China has sufficient policy space to ensure the economy eases into a somewhat lower growth trajectory rather than falls into recession. The more pertinent question one should ask is whether enough is being done to rebalance the domestic economy from investment to consumption to ensure a sustainable growth trajectory over the medium and long term.

The author is the senior resident representative of the IMF in China.

(China Daily 05/02/2012 page9)