The world is changing and consumption in the United States and in most of Europe is based on deficits. But the deficits cannot continue to grow much longer. Austerity measures have been taken or are being taken in Greece, Ireland and the United Kingdom, but programs to increase employment have not been established. Also, the proposed referendum in Greece is generating a high level of uncertainty over the stability of the euro.

The US still needs to reduce its consumption pattern in a big way, but the steps to achieve that will not come until after the presidential election in 2012.

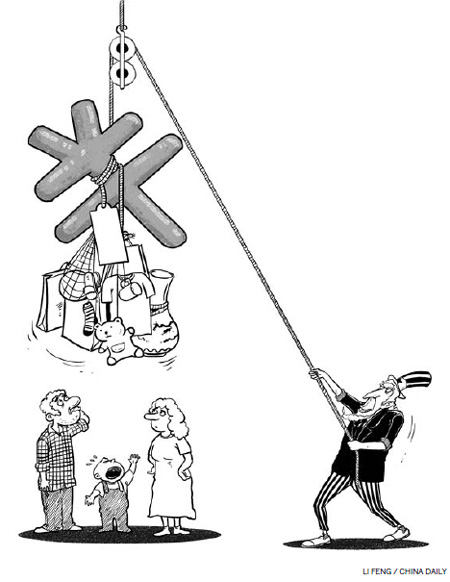

The proposed solutions to the economic problems in the US are to increase taxes for the rich and force China to revaluate its currency and make its manufacturers less efficient.

The US is a land of increasing income inequality. The main problem with it is that its middle class is shrinking for lack of high-paying jobs in manufacturing industries. Imposing higher taxes on the rich is like putting wallpaper on a cracked wall in a house that is crumbling and stands on a foundation that is sinking.

In addition to its internal deficits, the US also has a negative trade balance with China. According to US Census Bureau, in 2010, the US imported $365 billion worth of goods from China and its exports to China was $92 billion, creating a deficit of $273 billion. Why the big difference?

China makes iPhones and iPads for Apple because it is cheaper to make them in China than the US.

So if the value of the yuan increases, it will also raise prices for US consumers. Are American consumers willing to pay higher prices? Of course, Apple can absorb the increased cost and settle for less profit, but it will end up paying lower taxes. Will that be welcome by the US?

China is building its own industrial base and is becoming increasingly competitive in advanced technologies. For example, Chinese companies are outperforming most of the US companies in the solar industry. The US government provides large subsidies to American solar companies, with $535 million for Solyndra being the highest profile.

Should US consumers pay more for Chinese solar panels because US solar companies cannot compete with them on cost?

The "blame game" is rampant, and unfortunately, logic will not prevail as long as the main goal of US political leaders is to be re-elected. The enemy outside is easier to blame than the enemy within.

So, what will happen over the next few months?

Pressure will increase on China to continue increasing the yuan's value, even though the Chinese currency increased against the dollar by 6.7 percent from September 2010 to October 2011.

The US will impose tariffs on selected imports from China as a demonstration of action by its political leaders. But the net impact of these actions in 2012 will effectively be zero, and the trade deficit between the US and China will continue to increase.

The real problem for China, however, is that consumption growth in the US, Europe and Japan will slow down, and many factories set up in China by foreign companies that have supported its GDP growth of 9-10 percent will run at sub-optimal capacity levels, which will increase their cost per unit. To stimulate demand, such companies will reduce prices, which will further reduce their profits.

The Chinese industrial base will need to adapt to a lower growth rate, accelerate the shift to higher value products, and boost domestic consumption.

The demonstration of the Chinese supercomputer, Sunway BlueLight MPP, built with China-made processors and sophisticated water-cooling (based on cooling of power stations), is a welcome move. It is, however, more important to build the capabilities of China-designed and China-made products that can challenge the iPad and iPhone, which in turn can support hundreds of millions of consumers in China and also generate exports.

Moreover, a China-made automobile, which can contend with Toyota Camry or Honda Accord, needs to be developed, so that China can get a high share of the global market.

If China can build highly competitive railroad systems, it should also be able to build next-generation Internet access platforms that can support a wide range of content. Hence, a longer-term goal for China should be to develop technologies for telemedicine.

The technology for building value-added products is becoming available in China. Missing are the business models and management expertise. China needs to give the same importance to strengthening management skills as it gives to technology and manufacturing skills.

The changes that China needs to prevent a serious downturn in industrial output, however, will not help the US. The US needs to develop a new industrial base that can increase exports to China and other countries.

It is likely that the pendulums of China and the US will swing further apart in the short term. When leaders of the two countries get together in the future, hopefully their meeting will be more collaborative, because it is important to abandon the blame game.

We need to move forward to a new spring where businesses are started to create jobs and new products. Only if consumers have jobs, will they have the money to buy goods and services.

The seed that will enable successful long-term growth is new industries that create new jobs. Borrowing and blaming China and the rich that do not pay their fare share of taxes will continue the downward spiral of the US.

The author is founder and CEO of International Business Strategies Inc, an international consulting company based in Los Gatos, California. He is the author of Chinamerica: The Uneasy Partnership that Will Change the World (McGraw-Hill)

(China Daily 11/29/2011 page9)