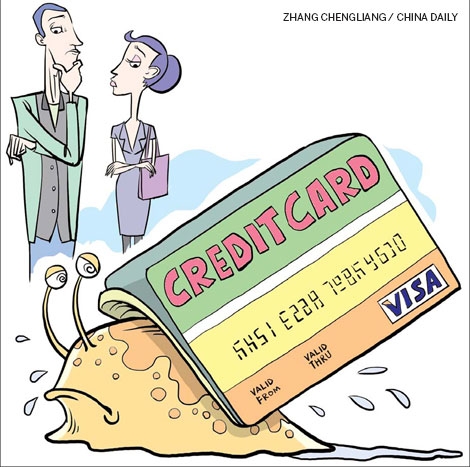

Credit cards aren't as popular as many hoped they would be

|

The world, teetering on the edge of another financial crisis, needs Chinese consumers to save less and spend more. Chinese consumers need to increase domestic demand so the country can reduce its heavy reliance on exports to keep fueling economic growth.

But Chinese consumers aren't playing ball. They are diligently saving money and cautious when it comes to spending money, evident by the country's consumption-to-GDP ratio of 36 percent - only half that of the United States and about two-thirds the figure for Europe.

Bank executives are optimistic that credit cards will be the answer to encouraging Chinese consumers to spend, just as they have on consumers elsewhere.

With about 230 million credit cards issued by 2010, bank executives are salivating at the prospect of tens of millions more consumers adding credit cards to their wallets.

With more than 2.1 billion debit cards in circulation for a population of about 1.3 billion, it is only natural to assume Chinese consumers have a voracious appetite for plastic and would therefore be as enthusiastic about credit cards. This expected exponential demand for credit cards hasn't happened.

Credit cards haven't proved to be particularly profitable so far. Profitability per card, according to the Lafferty Group, is thought to be roughly $1 per year.

New research conducted on young, affluent credit cardholders at a private university in China sheds light on why the picture is unlikely to improve dramatically for credit card companies any time soon.

The research, a joint project involving Australia's Monash University and The University of Nottingham Ningbo China, also suggests that we should not rely on consumer credit to structurally change how Chinese spend money, and, by implication, the world economy in the short term.

Credit cards, blamed for many a household's financial woes in the United States and Europe, are relatively new to China. They were only permitted beginning in the mid-1990s, resulting in structural impediments to the development of China's consumer finance industry.

It is well-known that the idea of saving is deeply entrenched in the Chinese culture. It is estimated that the average Chinese family saves 25 percent of its discretionary income - six times the savings rate for US households and three times the rate for Japanese.

Not common knowledge, however, is that youths are just as thrifty savers as the elderly. Urban households headed by 25-year-olds are believed to save about 30 percent of their disposable income. Households with sons are the main accumulators of assets, especially property.

We investigated the attitudes of young, affluent Chinese toward credit cards in order to determine whether they will become popular among this important group of consumers. It is, after all, among young people where major shifts in behavior tend to occur and how new consumer spending trends develop.

We chose The University of Nottingham's Ningbo, China, campus because it is located in Zhejiang, which is one of the most developed provinces in China, with high levels of income per capita and therefore a large potential for credit card usage.