The media are saturated with warnings of a possible financial collapse, perhaps triggered by Greece defaulting on sovereign debts and the fear that the rest of the European Union and even the world would follow suit. Portugal, Ireland and many other countries are burdened with unsustainable debt. The United States is facing a credit ceiling and if it does not raise it by Aug 2, it may not be able to pay public servants.

|

||||

Ironically, while Chinese may feel the least pain from the global financial crisis, there is a new wave of fresh thinking among Chinese scholars and strategists on how development can be truly scientific. What has gone wrong and where could it lead?

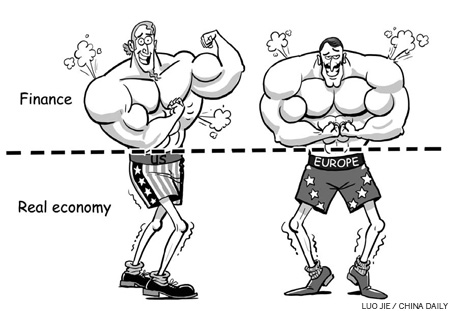

The newly elected International Monetary Fund Managing Director Christine Lagarde has warned of the worst-case scenario when no one would trust anyone to lend money. Mid-2011 may be the best time to take stock of the situation before the worst-case scenario becomes reality. What we have increasingly come to overlook is the role of money in real economy and society.

Money is a human invention based on trust that a paper bill or electronic signal represents real wealth somewhere. Money as a representation of power to buy whatever we want has become so ingrained in our mind that we have forgotten the obvious. People kill for money, "money never sleeps", and money speaks all languages and makes the world go round. But there is something more we need to retrace and rethink.

Pioneering economist Adam Smith in his The Wealth of Nations, published in 1776, explained money thus: "If among a nation of hunters, for example, it usually costs twice the labor to kill a beaver which it does to kill a deer, one beaver should naturally exchange for or be worth two deer." In other words, the cost would be 2 pounds for the beaver and 1 pound for the deer. Money ensured that animals were not cut open and remained easy to carry and store.

Fast forward 200 years, and we find Michael Milken "making" hundreds of millions of dollars by leveraging junk bonds against possible future returns. There were no animal carcasses to back up the money, and Milken went to jail, but the idea excited other dreams.

As the US' 30 boom years (after and because of World War II) reached a plateau of physical limits, politicians from former president Ronald Reagan onwards were elected on promises of continuing to do more of the same. Creativity in "financial products" in a deliberately deregulated environment took off, with only the brazen few bubble creators (World.com, Enron, Pamalat, Madoff) ending up in jail.

World politicians today become instant losers when they say constituents may be living beyond their physical means. The Greek government is wincing under incensed popular protests even as it bends over backwards for another gasp of borrowed injection.