Income growth, development of service industry to keep economy chugging along smoothly

|

|

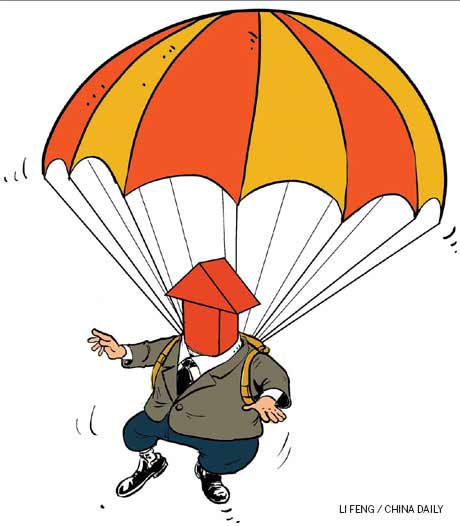

There has been heated discussion on whether the Chinese economy will experience a hard landing.

In a survey conducted by Caijing.com.cn, the news portal of China's leading business and finance magazine, most analysts with 35 institutes predict a decline in China's GDP growth rate.

The GDP rate in the second quarter of this year is expected to grow slower, from 9.7 percent to 9.4 percent year-on-year.

Some Chinese economists have pointed out that if the Chinese government continues to maintain the current austerity policy, China's economy will face a bigger risk of having a hard landing.

The growth rate of consumption is getting slower, industrial production is dropping significantly, the government is tightening control of the real estate industry and foreign demand is facing a new round of shrinking.

A research report by French bank Socit Gnrale warned that China's economy has been out of control since the country has been repeating the mistakes the United States made in 2007. The reports said the bursting of China's economic bubble will be the biggest risk to the global economy.

Will the Chinese government need to adjust its tightening policy, or should it keep it to the end? Will China's economy in the short term or medium term face a hard landing?

China's GDP growth in 2011 will probably be no lower than 9 percent, and no lower than 8 percent in 2012. There is little risk that China's economy in the short term will experience a hard landing.

The growth rate of consumer price index in the second half of this year will decline. The decline in inflationary pressure will lead the authorities to adjust its tight monetary policies, and the policies will gradually become more neutral from August and September this year.

However, if the Chinese government fails to seize the opportunities for economic restructuring but continues to rely on investment and exports to drive the economy instead, it will face problems of overcapacity and the threat of an asset bubble in the medium term, which will cause the decline of the growth rate.

The recent lower growth of consumption was largely related with the decline of car sales. The decline was partly due to the fact that the government ended the tax preferential policies for car purchases in mid-2010.

There are 60 car owners among a thousand people in China, which is far below the global standard of 220 vehicles among a thousand people . This means that there is still a lot of room for China's auto market.