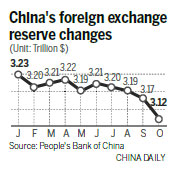

Foreign reserves fall in October

The fourth consecutive drop indicates heavy pressure from capital outflows

China's foreign exchange reserves fell for the fourth consecutive month in October, indicating sustained capital outflow pressure, despite initial signs of stabilization in the world's second-largest economy, analysts said.

Foreign exchange reserves fell by $45.73 billion - the biggest monthly drop since January - to $3.12 trillion, following a drop of $18.79 billion in September, the People's Bank of China, the central bank, said on Monday. They stood at the lowest level since March 2011, according to central bank data.

Analysts said the fall indicates heavy pressure from capital outflows for China, with the trend likely to continue in the short term.

"The drop suggests capital outflow pressure may have increased in October," said Liu Dongliang, senior currency analyst at China Merchants Securities.

The yuan's falling exchange rate against the US dollar is a factor behind the fall in foreign exchange reserves. The currency's central parity rate, set by the central bank, fell by 211 basis points on Monday to 6.77 against the US dollar. It has remained weak in recent months, which analysts say has driven the central bank to sell US dollars to support the yuan, thus leading to contraction of foreign exchange reserves.

Meanwhile, the strengthening US dollar has been seen as a major cause of China's falling foreign exchange reserves as it can cause capital to flow out of China, triggering central bank intervention.

Moreover, the rise in the US dollar can drive down the rates of other currencies, and as China's foreign exchange reserves are partly denominated by non-US dollar currencies, the reserve pool has contracted in terms of such currencies.

The greenback has risen broadly against major global currencies ahead of an expected interest rate hike by the US Federal Reserve in December.

Amid the US presidential election, uncertainties may drive international capital to buy US dollar assets as a safe haven, thus putting more pressure on China's foreign exchange reserves, Liu said.

The yuan might continue to depreciate against the US dollar, analysts said, putting pressure on China's foreign exchange reserve pool.

xinzhiming@chinadaily.com.cn

(China Daily 11/08/2016 page4)