Outlook and implications

In 2014, final sales data showed that most Chinese brands suffered a difficult year.

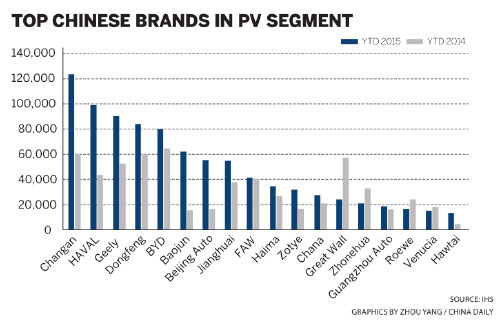

The situation today is a stark contrast as local Chinese brands are suddenly witnessing sales growth rates often in double digits.

The reason is that local brands raised their in-house technical standards, partnered with international suppliers and built better-quality models. More importantly, they have begun to target the highgrowth segment of SUVs.

Brands that reported low single-digit sales increases at the end of 2014 are now seeing double-digit growth, while those with negative growth are reporting positive numbers.

The focus of these Chinese automakers has shifted from producing many different models to targeting sales of models in growth segments and catering to specific target consumer groups.

The sheer volume increase in sales of local-brand SUVs shows that 2015 is the beginning of a targeting exercise from local brands, bringing better-quality products tailored for specific segments of the Chinese consumer market.

In the first two months of 2014, Chinese brands sold 203,136 SUVs. This rose by 52.18 percent to 424,770 units in the first two months of 2015.

The question is whether this growth of Chinese SUV sales will continue, and whether overall Chinese brands will continue to see growth in their local domestic market?

In the January-February period, Chinese Original Equipment Manufacturers, or OEMs, managed to increase their market share in PV sales, excluding imports and exports, to 32 percent from 26 percent in the same period last year. Meanwhile, Japanese OEMs seemed to lose momentum again in PV sales as their market share decreased to 15 percent from 17 percent in January-February 2014.

The strong rebound in domestic OEMs' performance is attributable, in particular, to the positive reception of their SUV products, especially those of Great Wall, Changan and JAC.

With more SUV products from Chinese OEMs to be launched this year, we expect domestic OEMs to at least increase their market share from 27 percent in 2014 to 28.8 percent in 2015.

International brands witnessed a rapid slowdown in sales growth rates of locally produced PVs in China, with a number of brands in negative territory.

Volkswagen's sales were up 4.1 percent year-on-year during the first two months this year with 543,896 locally produced PVs sold in the two-month period.

Hyundai's sales were down 6.3 percent year-on-year, Buick's were down 6.1 percent year-on-year, Ford's were up 16.8 percent year-on-year, Chevrolet's were down 1.2 percent year-on-year, Toyota's down 11.4 percent year-on-year, Kia's down 2.7 percent year-on-year, Honda's down 2.3 percent year-on-year and Nissan's down 13.6 percent year-on-year.

This is in stark contrast to the sudden jump in growth rates of local brands in China.