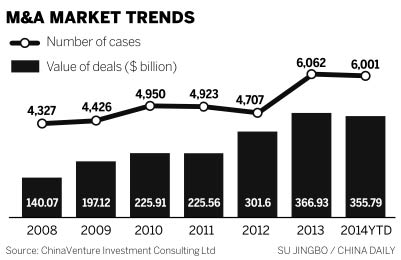

China's mergers and acquisitions market was worth $355.8 billion in the first 11 months of the year, a 3 percent drop on 2013 but a 154 percent rise on 2008, according to a report by ChinaVenture Group.

Liu Boyu, an analyst at ChinaVenture, said 6,001 M&A deals were announced by the end of November, "a good performance", helped by a "structural transformation of the economy and system innovation".

The State Council announced new rules in March and May to improve the M&A process for companies. In July, the China Securities Regulatory Commission also said it would simplify the review process for major asset restructuring programs and takeovers of listed companies.

The largest individual deal announced this year was by property developer Greenland Holding Group Co in March, a planned backdoor listing through an asset swap with Shanghai Jinfeng Investment Co which involved injection of assets worth 66.7 billion yuan ($10.8 billion), or 100 percent of its stake, into the Shanghai-listed company.

The ChinaVenture report said there were 2,209 deals completed in the Chinese M&A market during the 11-month period worth $158.3 billion, an 11 percent drop on last year but a significant 40 percent rise on 2008.

The largest deal completed this year was CITIC Ltd's August backdoor listing, through its Hong Kong-listed CITIC Pacific, worth 226.9 billion yuan.

The manufacturing sector enjoyed the largest number of deals (321), followed by the information technology and finance sectors.

Outbound M&A activity was brisk with 189 cross-border deals this year so far worth $33.4 billion, or 21.1 percent of the total value of deals completed in the domestic market during the period.

"The highlight of the global M&A market this year has been the growing number of deals clinched by companies from the mainland," said George Lu, partner for China transaction services at PricewaterhouseCoopers.

"We expect the growth momentum provided by these companies to continue into next year."