|

|

A unit of China's third largest port is in initial discussions with the London Metal Exchange to be listed as a delivery point, a move that may signal the end of a government ban on foreign exchanges setting up storage on the mainland.

An LME-approved warehouse on the mainland would boost international access to the domestic metals markets of the world's largest consumer and potentially increase volumes on the LME and the Shanghai Futures Exchange.

It would also close up loopholes in the LME's delivery network that have frustrated some Chinese customers.

The LME, which has registered warehouses worldwide, has tried for many years to set up storage facilities on the mainland.

The exchange is expected to have more success after it is bought out by the Hong Kong Exchanges and Clearing Limited (HKEx), which has close ties with the regulators in Beijing.

The HKEx has said it plans to support the LME to expand its warehouse network on the mainland. Its $2.2 billion acquisition of the LME is expected to be completed this year.

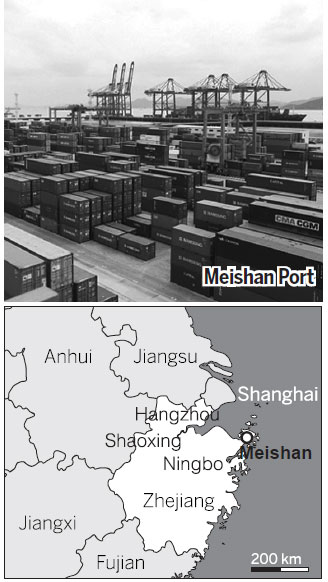

Meishan Port, which is administered by Ningbo Port, is doubling its available bonded storage area to 120,000 square meters by January, Zhang Hangfei, director of the investment cooperation bureau of the Meishan government, told Reuters.

"We have started talk with the LME looking at the possibility of a warehouse here," Zhang said, adding the port was also willing to build more facilities if asked by the LME.

"I believe Shanghai, Dalian and other bonded ports ... might also want to become approved LME warehouses because it can raise our profile," he said. Meishan island is located off the coast of Ningbo, a city in eastern China.

China's economic planning authority the National Development and Reform Commission and the nonferrous metals association are conducting a feasibility study for the first time on allowing the LME to set up warehouses on the mainland, two industry sources with government links said.

The study will look into minimum load out rates, a major concern for consumers who complain that small and slow deliveries have caused an artificial tightness in spot supplies, one of the sources said.

"One of the conditions is the LME cannot limit buyers from taking metals and the load out time has to be reasonable," the source said.

LME-registered warehouses can only release a fraction of their inventories each day, while mainland futures exchanges are not allowed to set delivery limits.

Slow delivery rates pushed aluminium premiums to record highs this year even though global demand was weak.